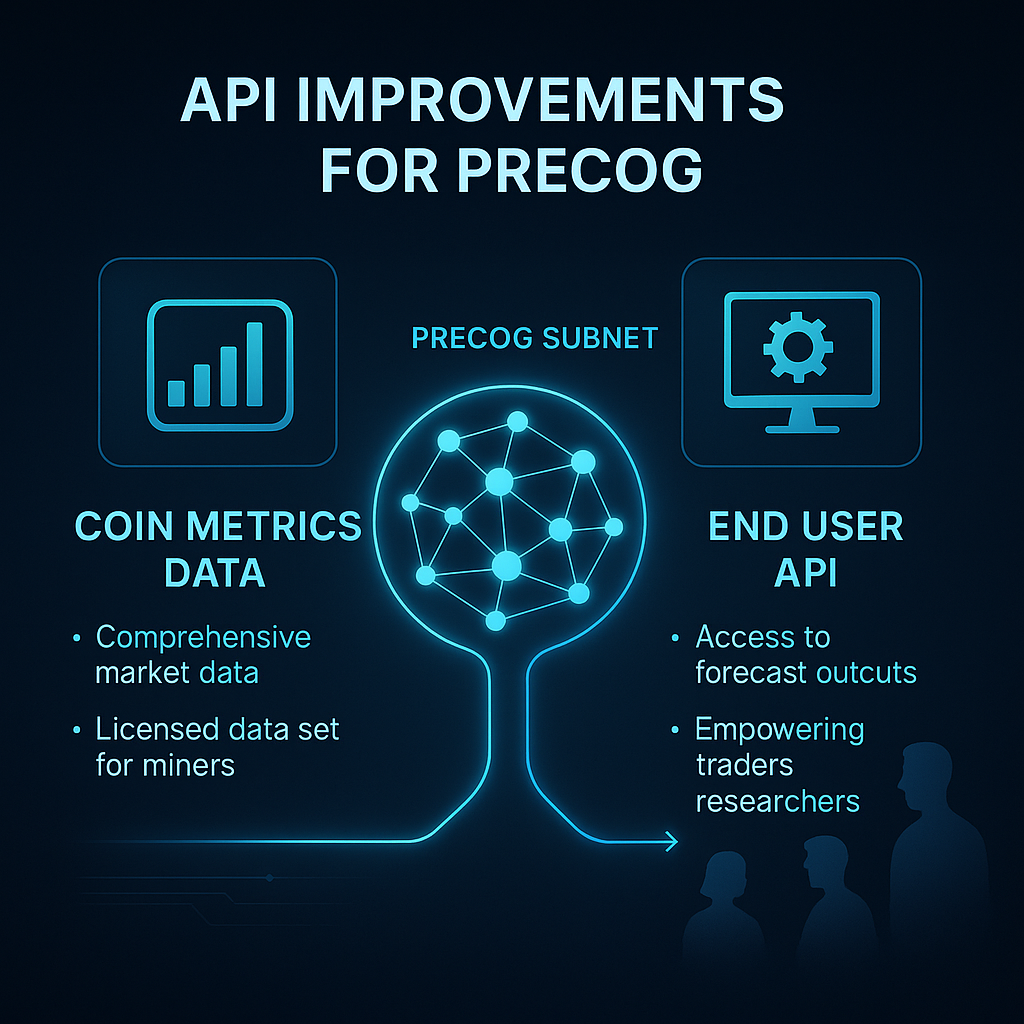

The Coin Metrics and Yuma teams have been hard at work in several directions to keep Precog growing and take it to the next level. We are developing infrastructure to enable public access to Precog forecasts for the first time. That means the community can begin to evaluate what our Miners are doing and testing their applications. This is also a necessary step on the road to monetization. Simultaneously, we are researching new functionality in our reward mechanisms to expand the tasks performed on the subnet. By generalizing the calculation, we can enable forecasts for arbitrary numbers of assets and different time scales. We also have improvements planned to our existing front end and are designing a new offering to make our core market data product more accessible for Precog participants.

End User API to Empower Traders, Researchers, and Others to Leverage Precog Outputs

Our main software development priority at the moment is standing up a service to deliver the Precog Subnet Forecast outputs to end users. This will allow the public to investigate the quality of our Miners’ outputs, write their own research reports, and determine its value in new use cases. Traders can incorporate this into a trading strategy, researchers can discover which market behavior decentralized models are most suited for, and miners can even use the outputs to refine their own results. We consider this a significant step for our subnet as it will make the results fully accessible and demonstrate the work our miners are doing to everyone interested in our subnet.

The initial data set provided will include the Point Forecast, Upper Interval Forecast, and Lower Interval Forecast each miner submits at each prediction time, along with identifiers. We may eventually implement a more direct monetization method, but initially these forecasts will not require payment. Access to the forecasts will, however, likely require a signature from a Bittensor wallet with a minimum Precog Alpha balance. This ensures participants have some skin in the game, the load on our servers comes from invested users, and is expected to encourage long term engagement and support in the subnet from all stakeholders.

More details regarding the development timeline will be shared next week.

Incentive Mechanism Extension to Allow Several Data Challenges

In terms of extending functionality and services, many discussions have revolved around two proposals: adding additional assets to forecast, like TAO, and adding different time horizons for predictions (e.g., forecasts for 1 day or 1 week in the future). Both proposals are versions of the same thing: Can we add additional forecast challenges beyond simply the BTC price Point Forecast and Interval Forecast? This could be taken even further to forecasting other data types.

Adding new forecast challenges requires additional work to extend the incentive mechanism. The main question essentially boils down to whether we want to require each Miner to predict every challenge with equal weight for their evaluation, whether the Miners should be able to choose which challenges they attempt and with what weight, or (most likely) some hybrid calculation. We also need to determine exactly how the reward mechanism will balance performance over each challenge. Both extremes have limitations, but we are working on a mathematical way to balance these considerations. In the coming days, we’ll share a write-up of our proposal with the community for discussion and feedback. Our goal is to find the mechanism that rewards the best possible results while covering a wider set of valuable markets.

Front-End – Trading Sims on Dashboard

We are also planning an upgrade to our Dashboard which will simulate how real-time trading strategies perform on a rolling basis These will show as charts similar to the plots described in our previous research articles, but updated continuously with the latest forecast results.

Coin Metrics Market Data for Precog – Elevating the Performance of Miners Though Access to Industry Leading Data Sets

Coin Metrics’ core business is our deep and broad catalog of cryptocurrency data. Currently Precog Miners and Validators can access our free Community offering, which includes maximum frequency available of the past 7 days of price and candle history, along with 24 hours of all other market data. It does not however include some derived metrics.

We are creating a plan tailored specifically to Precog Miners that will give them access to the most useful data for backtesting and modeling at a user-friendly price point. We are also working on the finance side to determine how to accept payment in TAO to reduce friction for native Bittensor users. Several participants have previously asked how they can obtain longer-term historical data but until now have been priced out because our product offerings are tailored to institutional clients and their needs. We hope this will provide the top miners with access to the resources they need to further improve the quality of Precog Forecasts.

We’re finalizing a data package tailored for top Precog Miners, focused on Bitcoin as the base asset. More details to follow.

Stay Updated

Keep in the loop of all things Precog! You can find us on: