Celebrating Ethereum’s 10th Birthday

Ethereum has come a long way since its ambitious launch in 2015. From smart contracts to staking to the meme-worthy gas fees, it’s been a decade packed with innovation and transformation. In honor of Ethereum’s 10th birthday, we’re looking back at 10 pivotal moments that shaped ETH into what it is today.

For a deep dive into Ethereum, check out our analyst report.

1. 2014: The Ethereum Presale

Before there was a live network or a functioning product, there was the Ethereum presale. Back in mid-2014, the Ethereum Foundation sold ETH starting at a fixed rate of 2,000 ETH per BTC for the first two weeks, linearly declining after that to a final rate of 1337. The sale lasted 42 days. Over 31K BTC was raised worth ~$18.3M for a total of 60M ETH sold, helping to kickstart the Ethereum ecosystem. It also set the tone for crypto fundraising in the years to follow.

Recommended Reading:

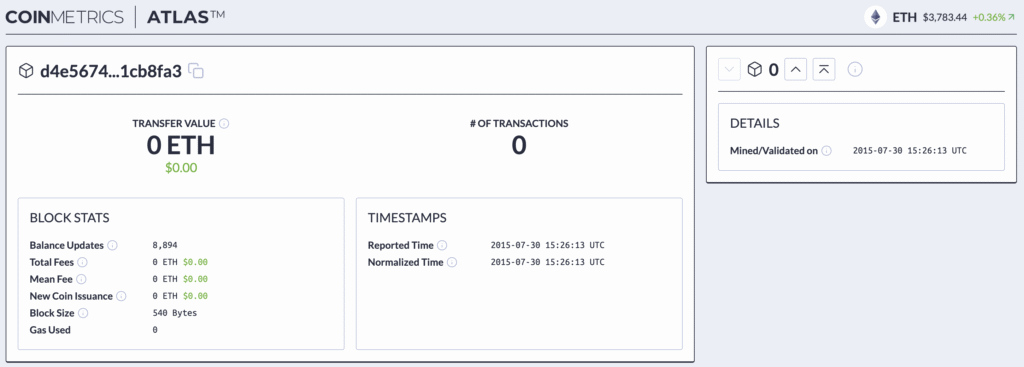

2. 2015: Genesis Block Launch

On July 30, 2015, Ethereum’s genesis block was mined, officially bringing the network to life. You can revisit that historic moment here on Coin Metrics Atlas. The Ethereum Virtual Machine (EVM) launched alongside it, introducing a programmable blockchain to the world, one that quickly caught the attention of developers.

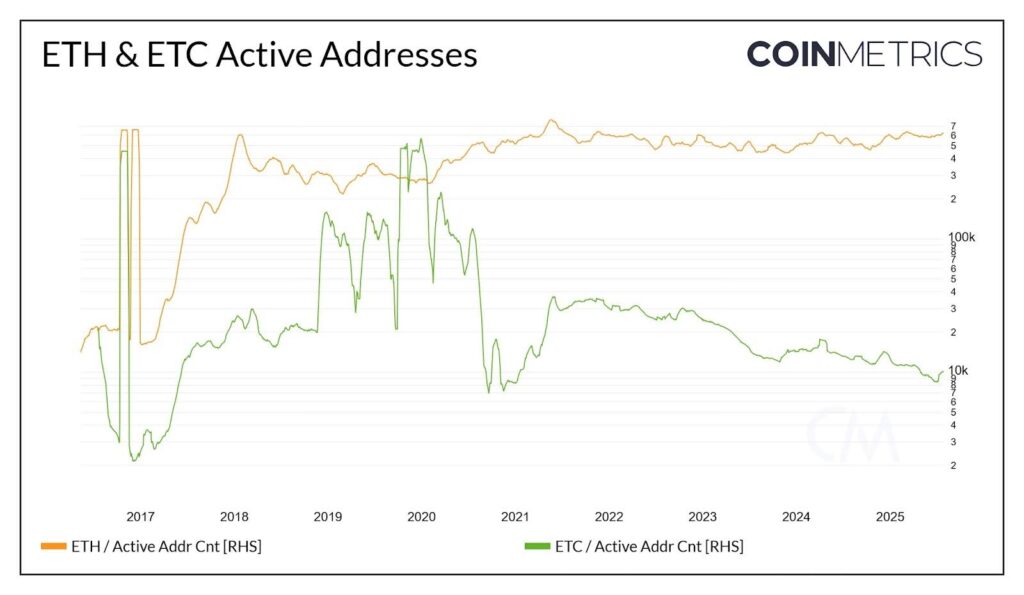

3. 2016: The DAO

The DAO was one of Ethereum’s earliest high-profile experiments: a decentralized venture fund governed by code. But just weeks after raising over $150 million worth of ETH, a vulnerability was exploited, draining a third of its funds. The fallout led to a controversial hard fork, effectively splitting the network into Ethereum (ETH) and Ethereum Classic (ETC). Internal disagreements among Ethereum’s leadership only added to the tension, but the community ultimately rallied around the ETH chain.

Recommended Reading:

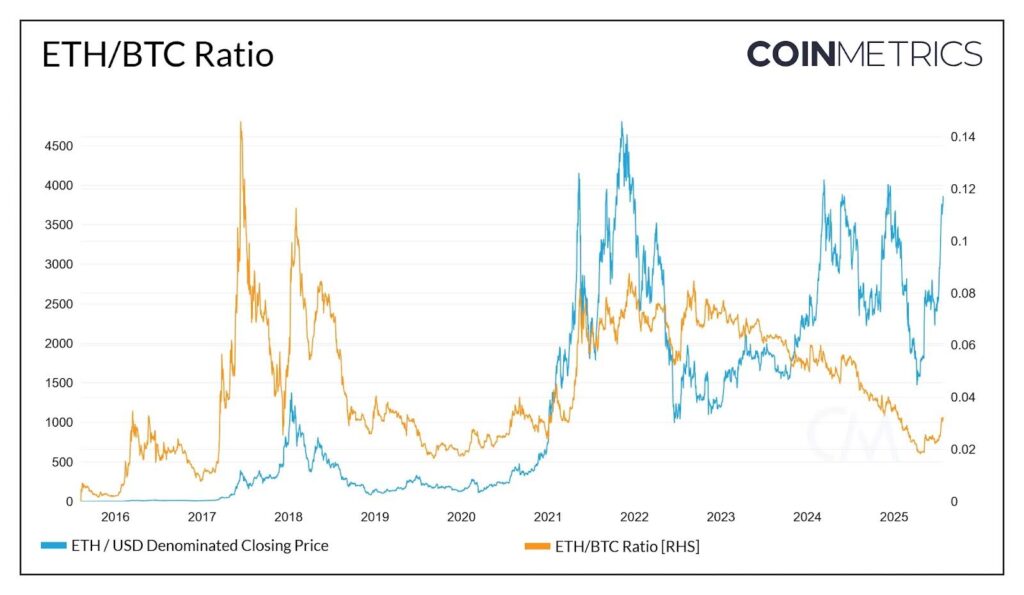

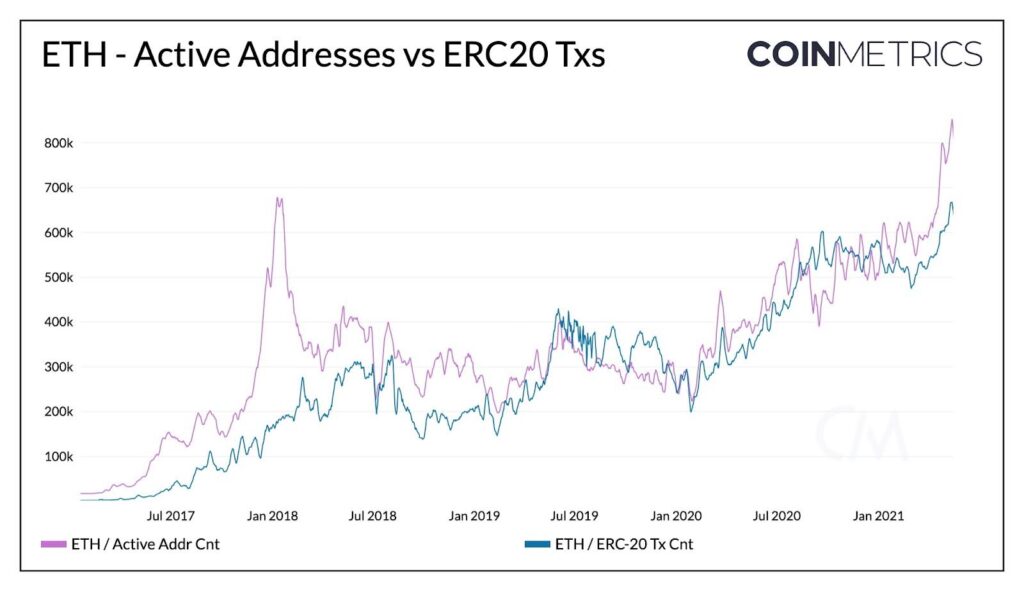

4. 2017: ERC-20 and the ICO Boom

Ethereum’s ERC-20 token standard was quietly published in late 2015 but really hit its stride in 2017. By making it easy to issue tokens, Ethereum became the launchpad for thousands of Initial Coin Offerings (ICOs). Some of those projects fizzled fast, but others, like Chainlink and Aave, became mainstays of the crypto landscape. ETH usage soared, and gas fees went along for the ride.

Recommended Reading:

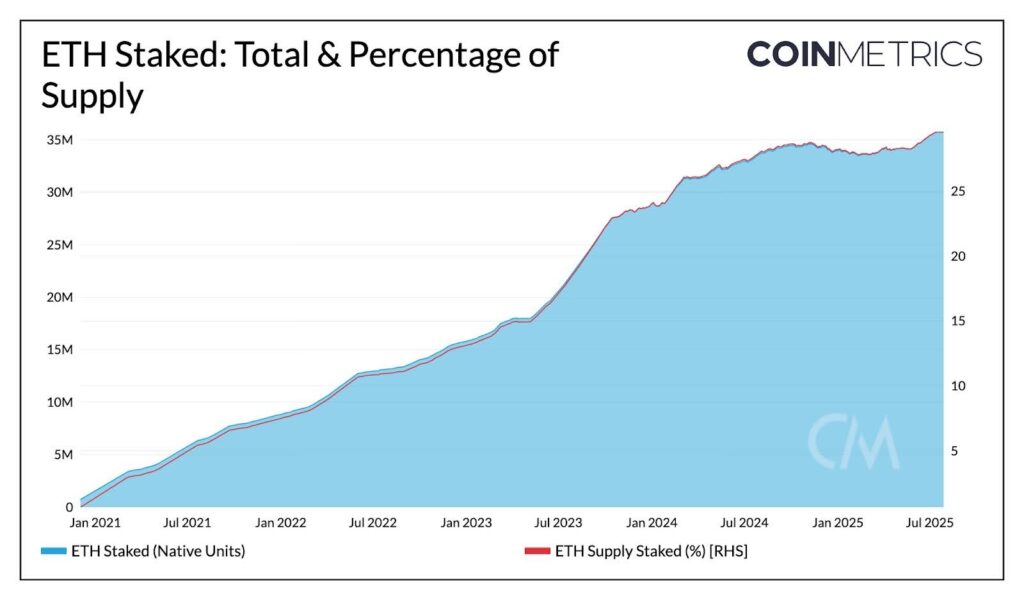

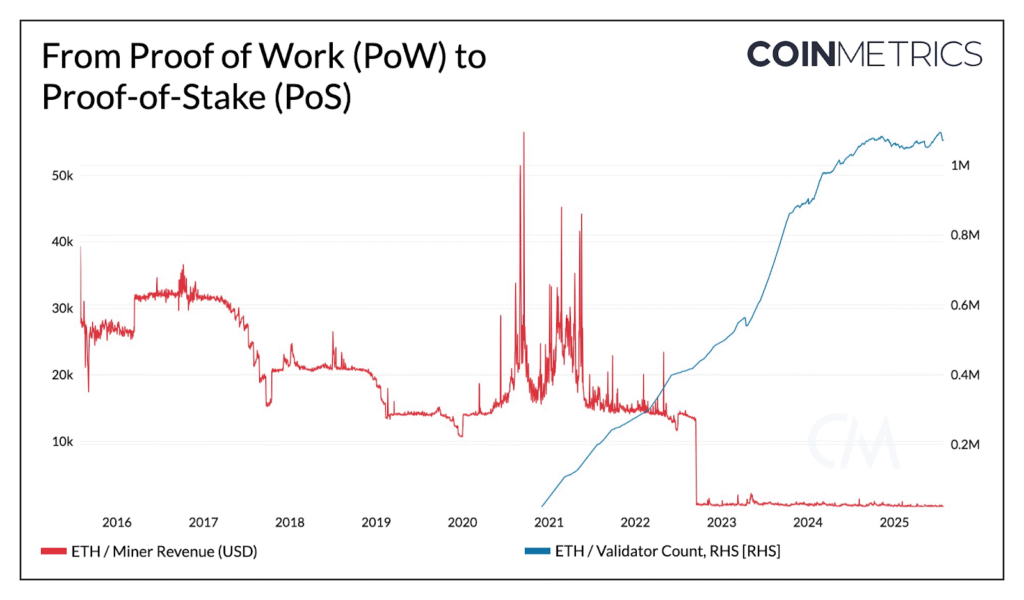

5. 2020: Launch of the Beacon Chain

After years of research and anticipation, Ethereum’s long-awaited transition to proof-of-stake began with the launch of the Beacon Chain on December 1, 2020. This new consensus layer ran in parallel to the existing Ethereum chain, quietly validating blocks and setting the foundation for Ethereum’s future.

Recommended Reading:

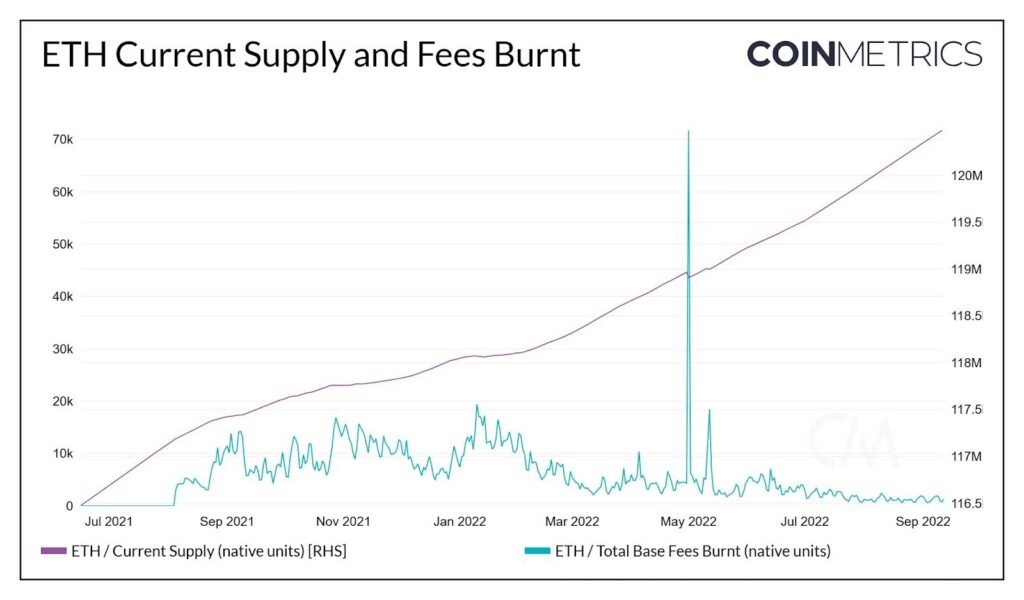

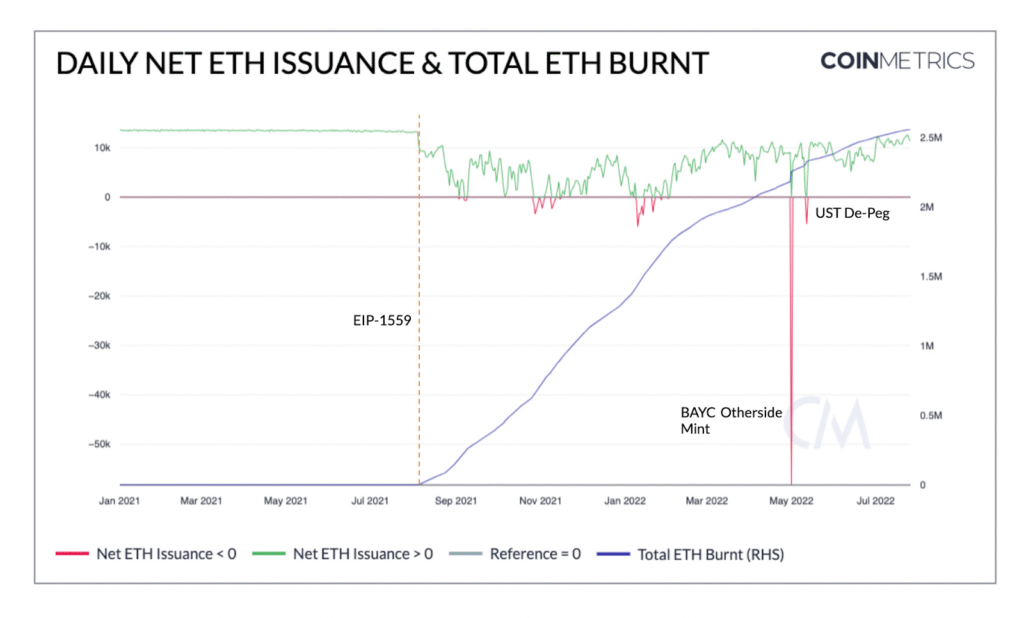

6. 2021: London Hard Fork and EIP-1559

The London upgrade introduced EIP-1559, fundamentally changing how Ethereum handles transaction fees. Instead of all fees going to miners, a portion began being burned, reducing the total ETH supply over time. It was a big step toward ETH’s “ultra sound money” narrative and added new dimensions to Ethereum’s economic model.

Recommended Reading:

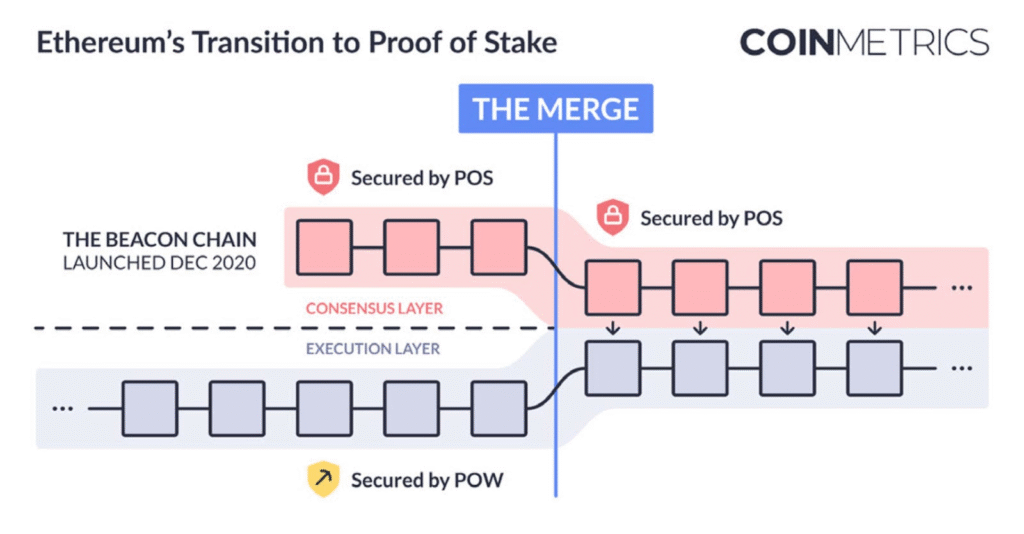

7. 2022: The Merge

The Merge was arguably Ethereum’s biggest technical achievement to date. In September 2022, Ethereum successfully transitioned from proof-of-work to proof-of-stake – without disrupting the network. Energy usage dropped by more than 99%, and Ethereum became the most prominent proof-of-stake blockchain overnight.

Recommended Reading:

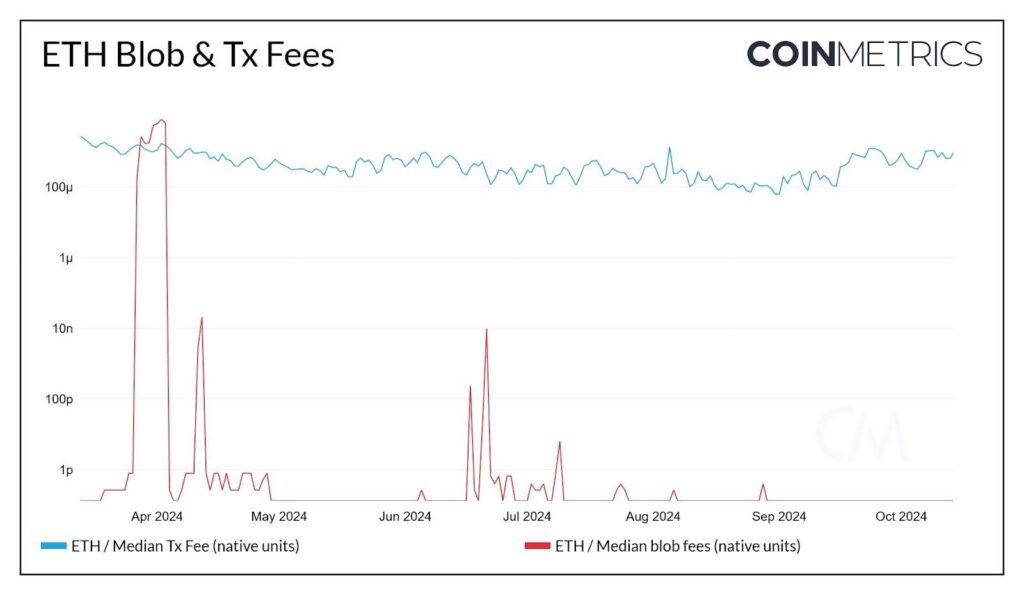

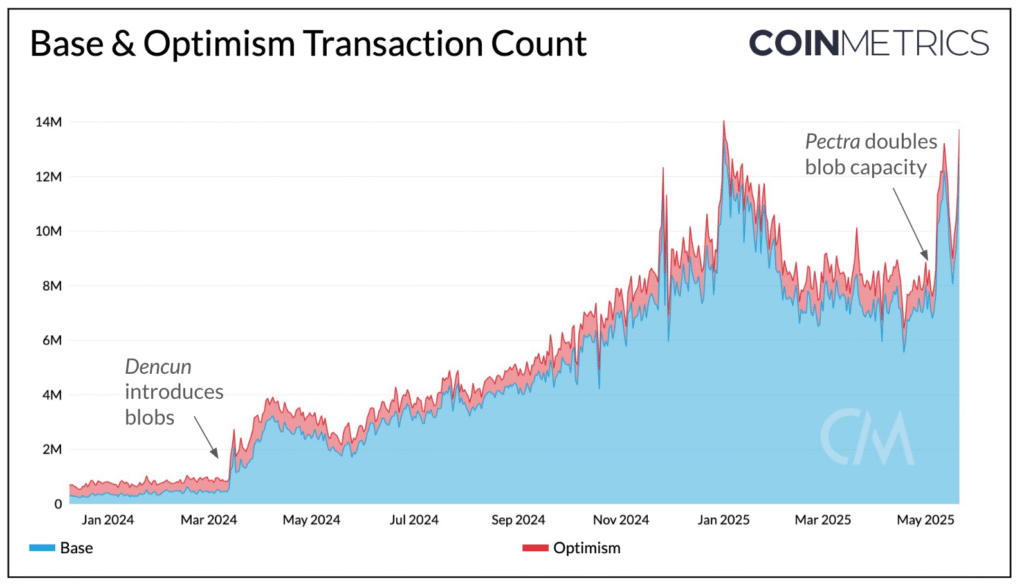

8. 2024: Dencun Upgrade and Rise of Layer 2s

The Dencun upgrade marked another major milestone in Ethereum’s scalability journey. It introduced “blobs,” a new data structure that makes it cheaper to post transaction data from Layer 2 rollups, providing a key building block for reducing fees. Layer 2 Networks like Optimism, Arbitrum, Base, and zkSync gained substantial popularity in 2024, reinforcing the belief in scaling Ethereum for broader adoption.

Recommended Reading:

9. 2024: ETH ETF Approval and Launch

After years of speculation, Ethereum finally got the nod from regulators. The approval of spot ETH ETFs signaled a new level of institutional acceptance. It also helped establish ETH as a financial asset, not just a technology platform.

Approval was only the first step. Actual trading began shortly after, and ETH ETF flows are now an important part of Ethereum’s market structure. Watching ETH move in and out of ETF custody has become a new way to gauge investor sentiment.

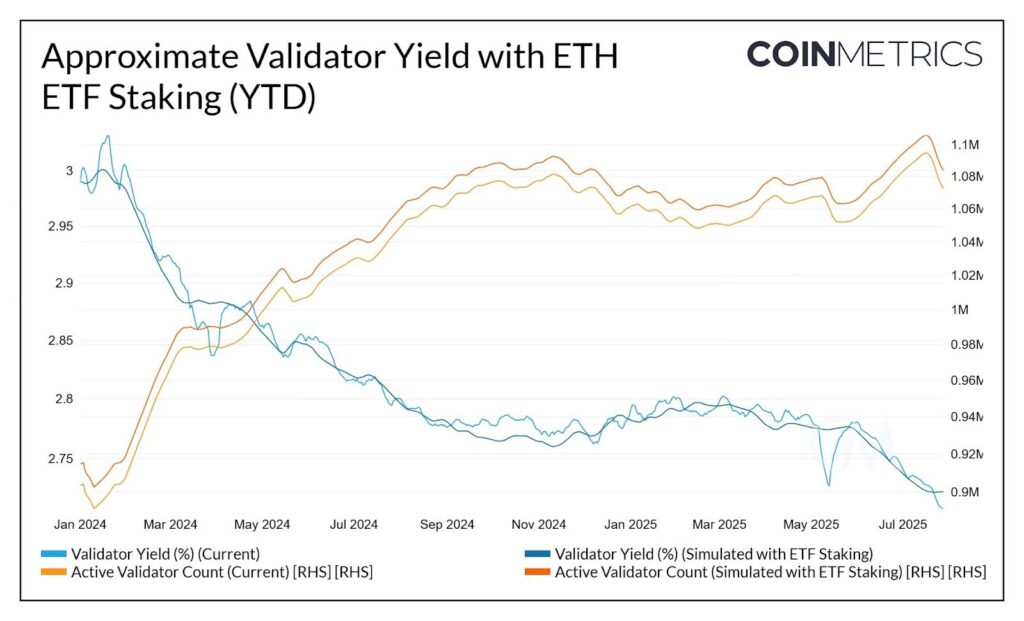

While ETH ETF staking is not currently approved as of July 2025, several issuers such as BlackRock and Fidelity have filed for amendments requesting to stake some or all of the ETH held by their funds.

Recommended Reading:

10. 2025: ETH Treasuries Gain Momentum

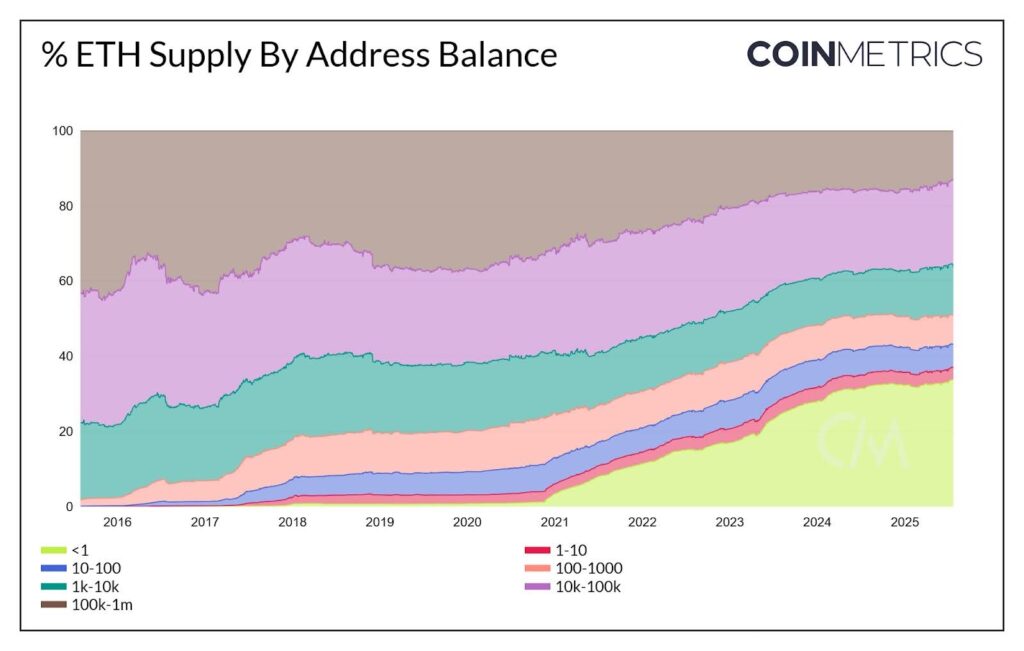

As ETH matures, it’s not only investors and speculators holding it. In 2025, ETH is becoming a treasury asset as a number of both private and public companies have started accumulating ETH, with it being held, spent, and managed like corporate capital. This growing trend supports ETH’s role not just as gas or collateral, but as an important diversifying asset in company treasuries.

Recommended Reading:

Ethereum’s first 10 years have been anything but boring. From a scrappy idea in a white paper to a global settlement layer powering billions in assets, Ethereum has consistently evolved, and often redefined what’s possible in crypto.

We’re excited to see what the next 10 years bring!