Chapter IV

Why Does Crypto Need Indexes?

You may be asking yourself why does crypto need indexes.

Some may argue that as a decentralized asset class, crypto does not need integration with a traditional finance product, however, indexes serve to strengthen and expand crypto through a variety of ways.

First and foremost, single-asset indexes aggregate prices to provide users with an accurate price and single data point for a given cryptocurrency.

Given the decentralized nature of crypto, assets are traded at different prices across exchanges. At any moment, an asset could be valued at multiple different levels at the same time. More stark examples have occurred in the past few years, where liquidity pressures have caused both a sharp over- and underperformance of an asset on a particular exchange. This obviously creates problems for investors and researchers who need a reliable price or a single data point to correctly track an asset. CMBI Indexes solve this problem by aggregating and weighting data from multiple exchanges. For example, when certain exchanges have had price dislocations due to liquidity issues or increased market volatility, our single-asset indexes were able to maintain an accurate price level, helping users of our benchmarks track the underlying asset.

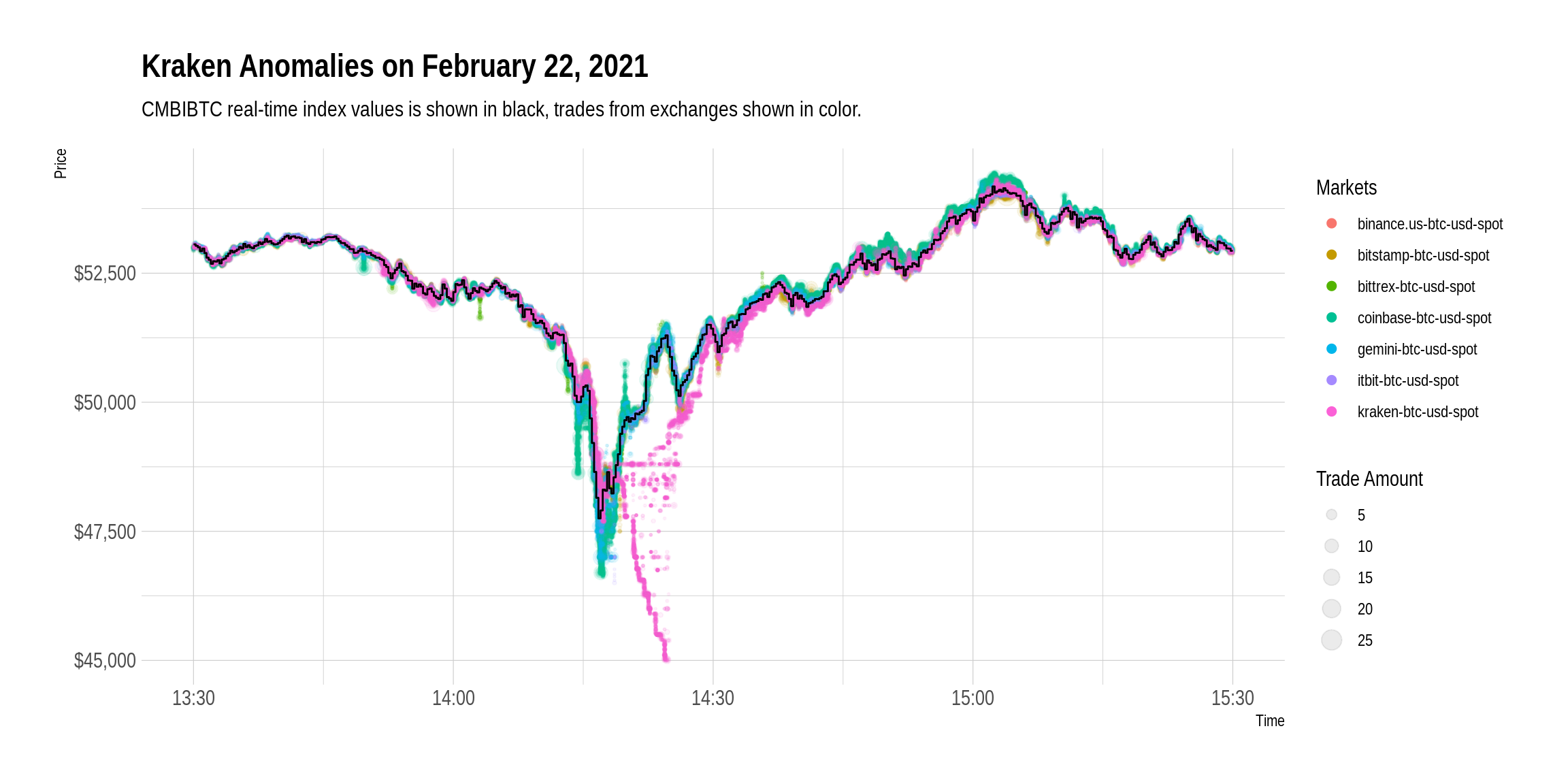

On February 22, 2021, Kraken experienced a significant number of anomalous trades as its liquidation engine forcibly closed positions of traders with margin positions. The price on Kraken fell roughly 22% to below $45,000 and trades were exceptionally volatile as the forced liquidations ended since these trades had exhausted nearly the entire bid side of the order book. It took some time before the order book state returned to normal. Kraken is the second largest exchange by market share in the BTC-USD trading pair. Coin Metrics’ index values were unaffected during this incident.

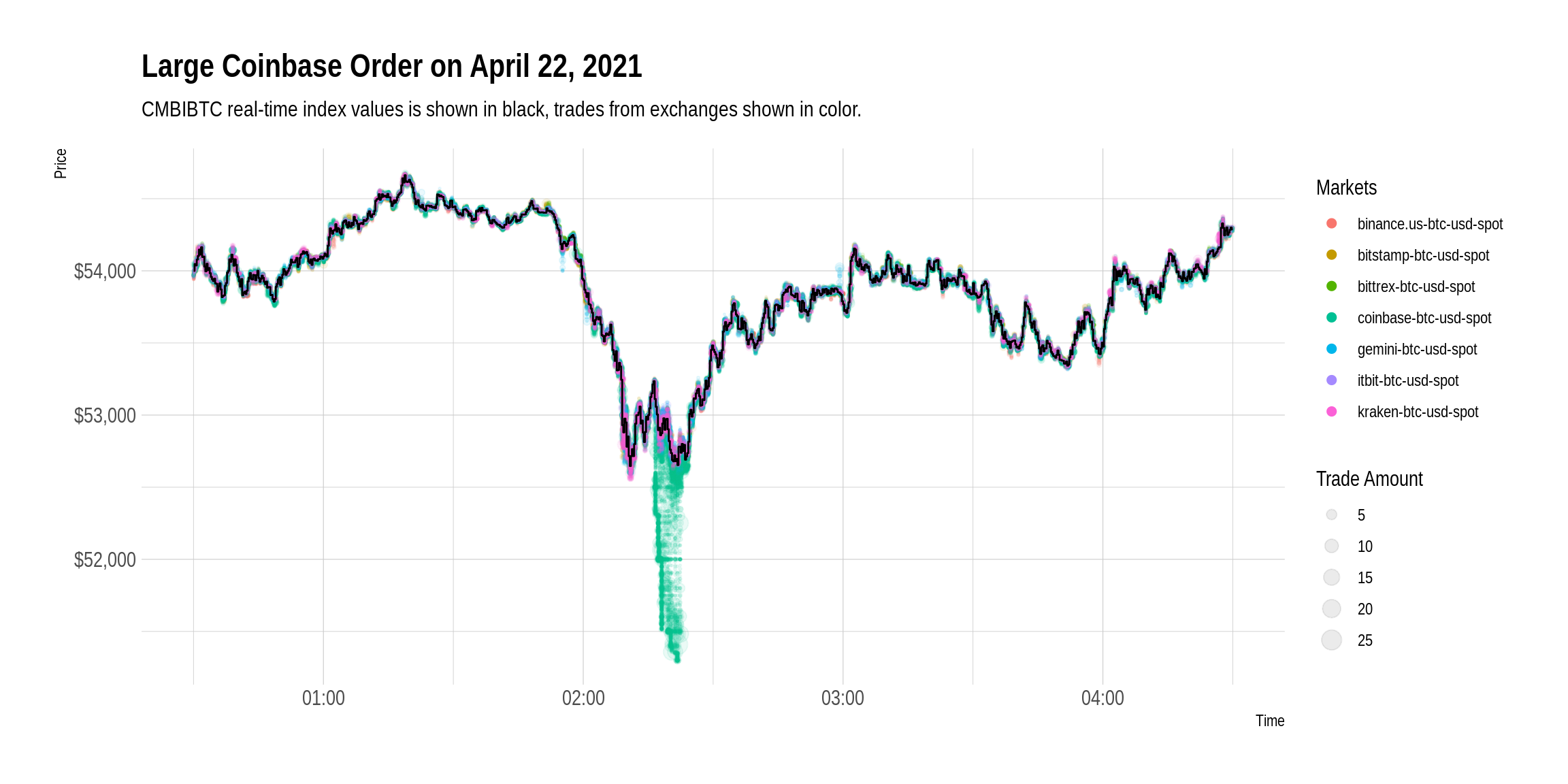

On April 22, 2021, someone placed a large trade on the Coinbase BTC-USD market. The large sized sell order caused price slippage, which resulted in the price of BTC dropping to below $51,400. Our index values represented the global price of BTC, as shown by its alignment with other exchanges.

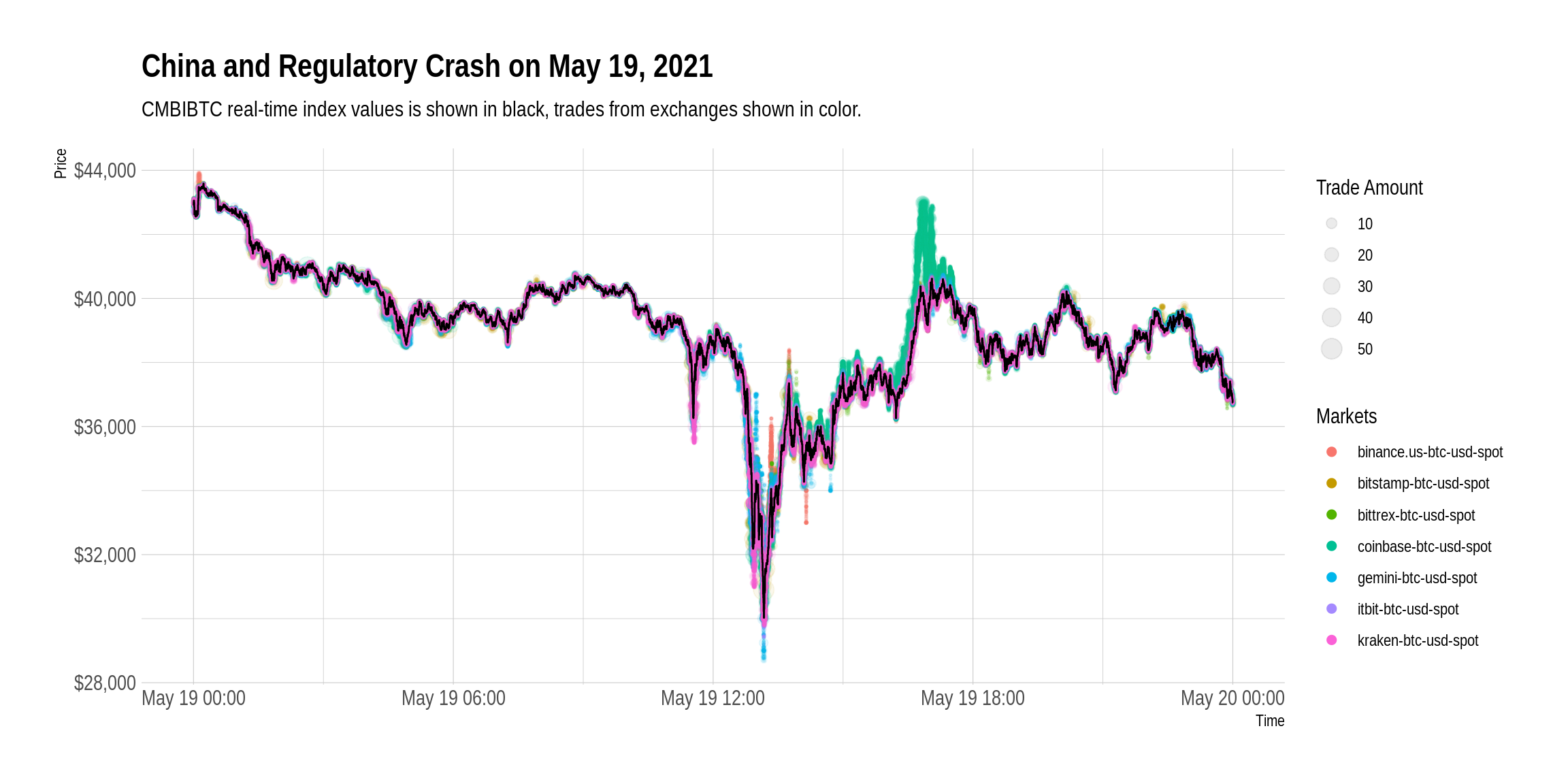

The crypto market experienced a significant pullback on May 19th, leading to a liquidation-driven selloff that brought Bitcoin back down to a low of around $30k. The surge in activity resulted in downtime for many exchanges including Coinbase, Binance.us, Kraken, Gemini and Bitstamp. You’ll see that during this volatility, the BTC-USD price traded at a wide range on the individual exchanges. Our Real-Time rate remained strong during this volatility, and served as a reliable representation of the global market price.

Another key value proposition for crypto indexes is the tracking of groups and themes in the crypto universe.

As crypto has grown outside one or two dominant assets, it has become necessary to track larger groups of assets to understand the crypto market’s overall performance. With the success of new asset classes like DeFi, NFT and the Metaverse, and Layer-1 smart contract alternatives to Ethereum, individuals can no longer just track the price of Bitcoin and/or Ethereum to discern the health of the crypto ecosystem. Multi-asset indexes fill that void by tracking a basket of assets to provide a more accurate benchmark for the wider crypto market. Furthermore, thematic indexes have the ability to track specific swaths or sectors for this space. There will be targeted crypto indexes, which will enable users to have tools for every basket of crypto assets imaginable.

Finally, indexes are required benchmarks for index-linked products such as mutual funds or ETP offerings.

Therefore, with cryptoasset index-linked products growing globally, the need for transparent crypto single-asset and multi-asset indexes will continue to grow. ETFs will expand the reach of crypto further in the investable universe. Unlike holding cryptoassets directly, an ETF or mutual fund is not subject to security and custody challenges. This enables the holder to be protected in the case of a potential account hacking. This is especially the case for multi-asset and thematic indexes, where investors can buy one fund instead of having to monitor multiple trades and custodies.

ETFs also unlock the potential for investors to short sell Bitcoin or any other cryptoasset, something which can only be mimicked in the current crypto trading paradigm. Finally, given that crypto is currently largely unregulated, many potential investors, like sovereign wealth and pension funds, are unable to hold the asset or invest in crypto. By creating an ETF, crypto would unlock large pools of capital to flow into the space.

Crypto indexes are also mandated for derivative offerings in traditional markets.

Generally, derivative products use indexes for contract settlement in traditional markets. As exchanges offer crypto-linked derivatives products, they will similarly need to rely on crypto indexes as a trusted value for contracts to settle on. Again, the fragmented nature of crypto markets makes it even more important for derivative products torely on crypto indexes to be the single, reliable source of truth.

Chapter V

What Does CMBI Provide?

You may be wondering why you should choose Coin Metrics as your index provider.