Bitcoin (BTC) has had many forks over the years, most of which have faded into obscurity. But one fork in particular has separated from the pack: Bitcoin Cash (BCH).

In August 2017, BCH forked from BTC with a goal of “fulfilling the original promise of Bitcoin as ‘Peer-to-Peer Electronic Cash.’” Proponents of BCH believed that BTC was increasingly becoming a store of value as opposed to a medium of exchange, the latter of which they saw as the original purpose of BTC. To achieve this, they argued that it was necessary to increase BTC’s block size from 1 MB to 8 MB (and eventually to 32 MB), which would allow for more transactions per block and lower transaction fees (only a limited amount of data can be added to each block — the smaller the block size the more users are incentivized to pay fees to make sure their transactions are included in a timely manner).

In contrast, opponents of the BCH fork argued that increasing block size would ultimately lead to greater centralization. Larger block sizes mean that the total size of the ledger grows at a faster rate. Each full node operator (which includes, but is not limited to, miners, merchants, and auditors) needs to be able to download and store the entire ledger. They also need to propagate blocks across the peer to peer network. If the ledger grows too large too fast it becomes increasingly difficult for average full node operators to maintain the necessary hardware and internet bandwidth, which can lead to concentration of power.

In November, 2018, a new fork split from BCH: Bitcoin Satoshi’s Vision (BSV). BSV forked from BCH with a similar goal of returning to Satoshi’s “original vision” (hence the name) of Bitcoin as peer-to-peer electronic cash. BSV expanded BCH’s scope, and further increased block size to 128 MB. Additionally, BSV eliminated the size restriction on OP_RETURN transactions, which resulted in a higher capacity for data storage on the BSV blockchain. BSV also elected not to adopt the OP_CHECKDATASIG opcode (which extends the scripting language to enable verification of signatures of arbitrary data), which was added by BCH. Ultimately, BSV aimed to “replace every payment system in the world with a better user experience, a cheaper merchant cost, and a safer level of security.”

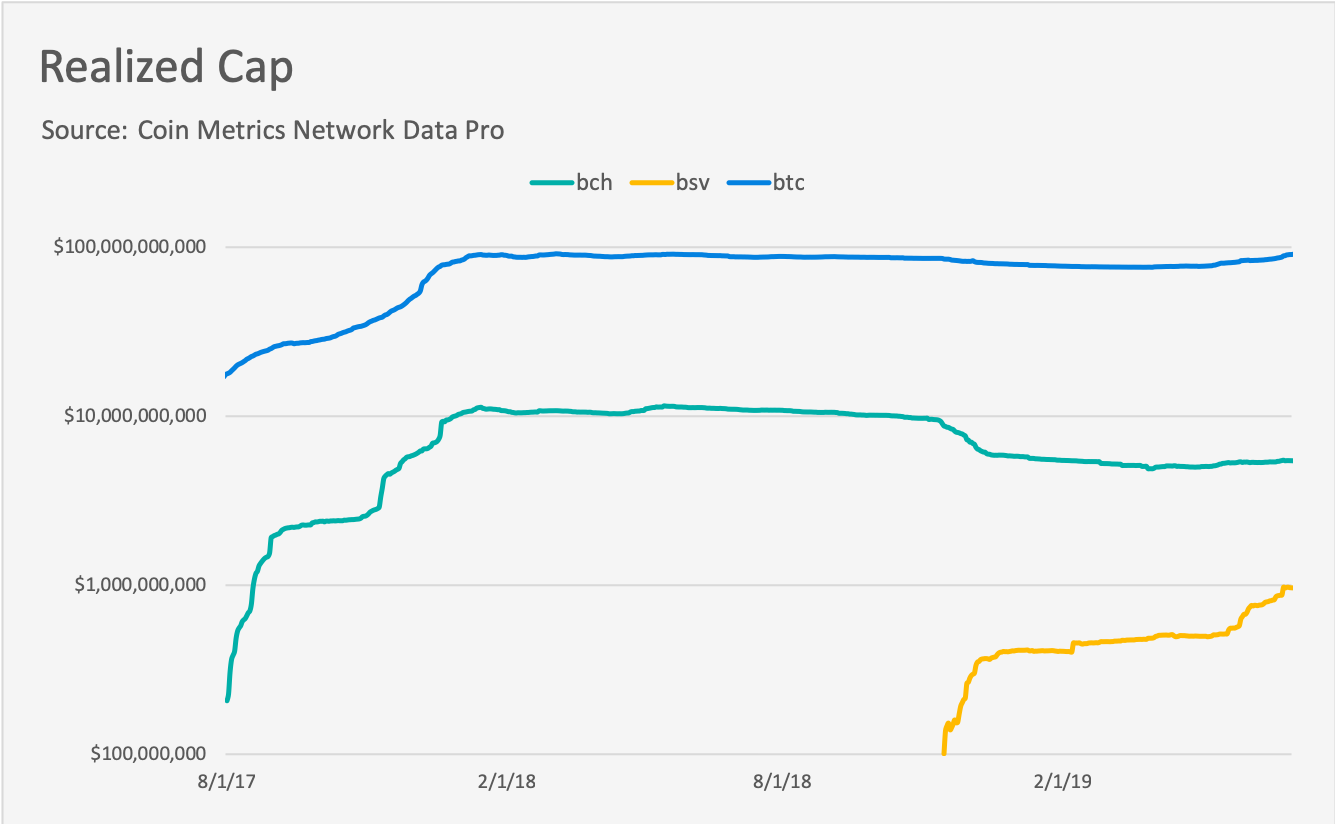

BCH and BSV currently have the 5th and 11th highest realized cap, respectively, out of all of the assets that we compute this metric for. Realized cap is calculated by valuing each piece of the supply at the price it last moved. In other words, it prices the supply at the time holders “realized” their gains or losses. The below chart shows realized cap for BTC, BCH, and BSV on a log scale:

In this piece, we compare on-chain activity for BTC, BCH and BSV, and analyze whether the two forks have achieved their proponents’ stated goals. First, we examine if there is evidence that they are being used as “peer-to-peer electronic cash,” which we henceforth refer to as a “medium of exchange.” Next, we look at differences in block size, and analyze whether and how the increased block space is being utilized. Finally, we examine security, and analyze the effects the forks have had on metrics like hash rate and mining revenue.

Medium of Exchange Analysis

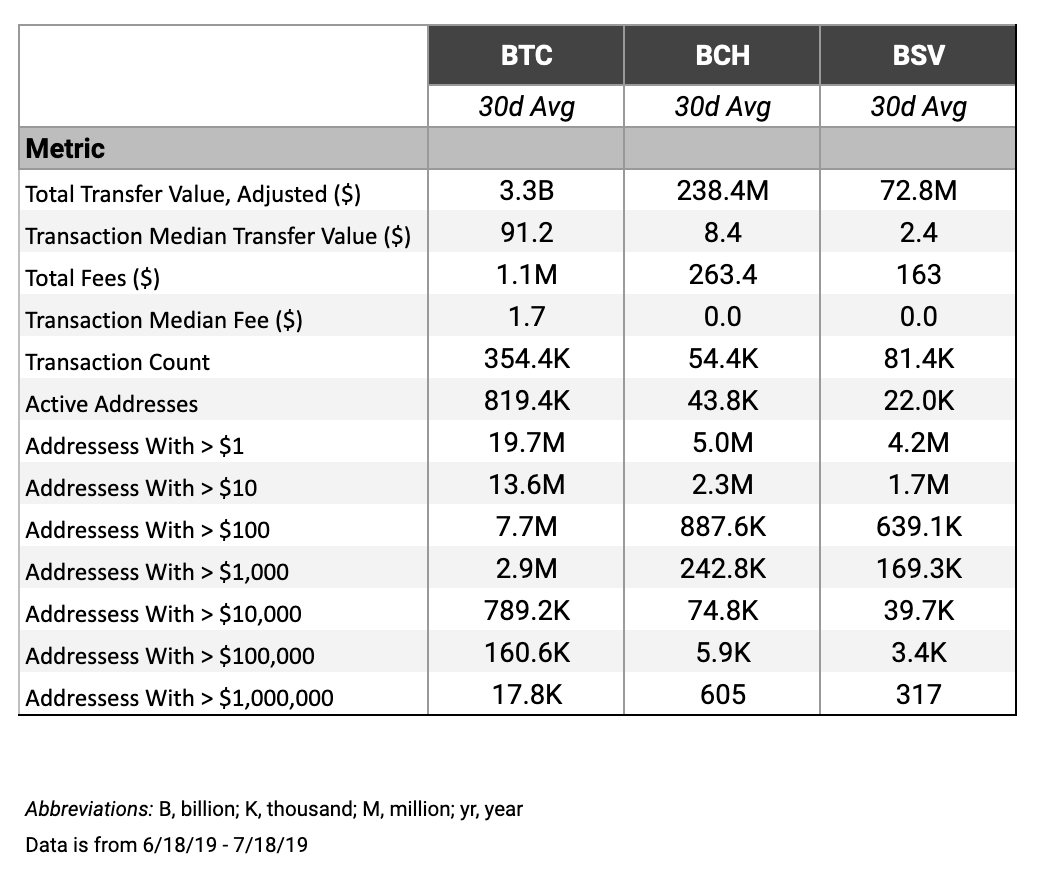

In this section we examine on-chain activity for BCH, BSV, and BTC, and analyze the degree to which these assets are being used as a medium of exchange. Although there’s no exact definition of how to measure a “medium of exchange” asset, we expect a medium of exchange asset to have relatively low fees, a high number of transactions, and large amount of value transferred. Additionally, there should be a high number of unique users actively using the network. We analyze various metrics, including adjusted transfer value, transaction count, and active addresses to gauge economic usage of each of the three assets.

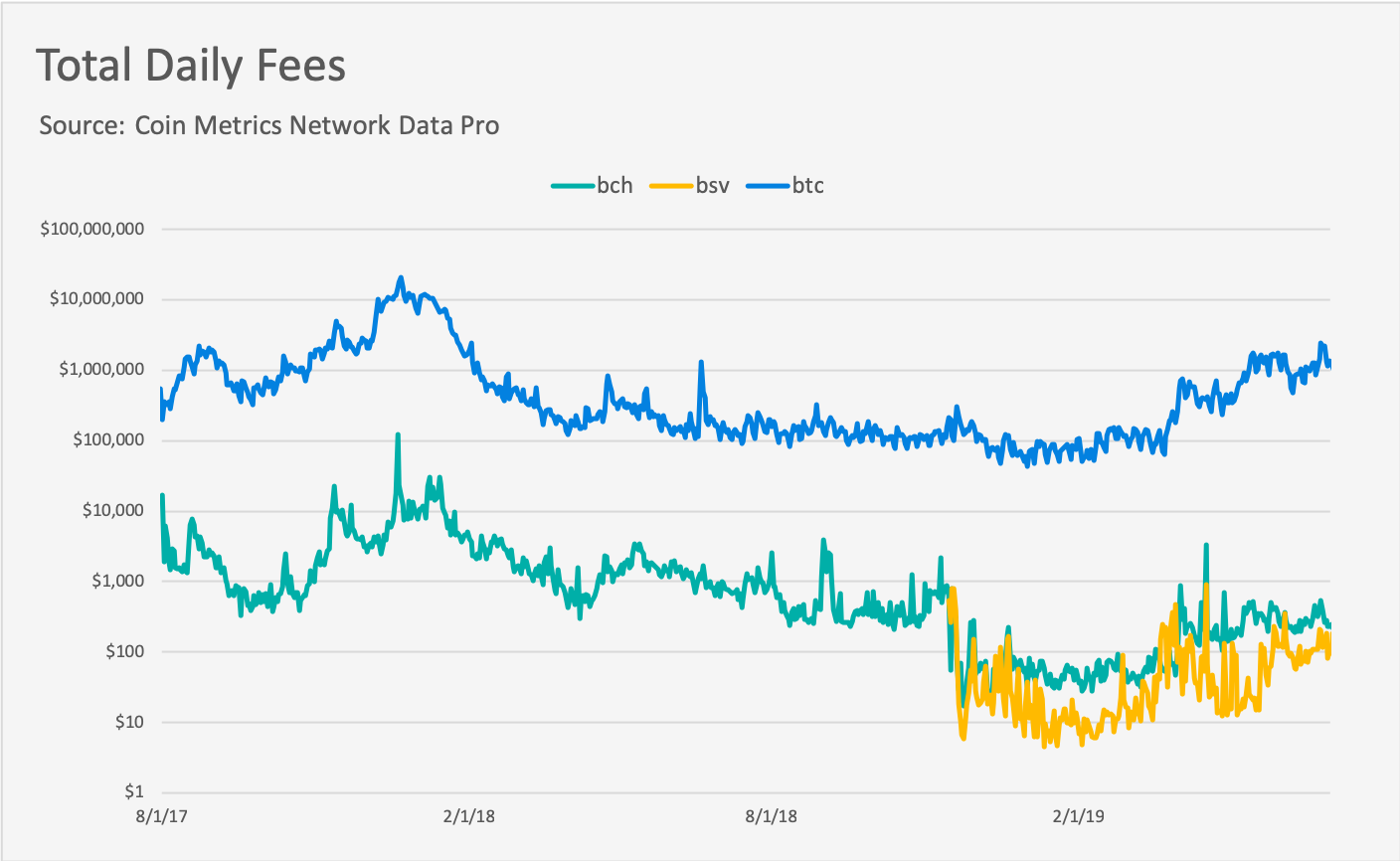

Fees

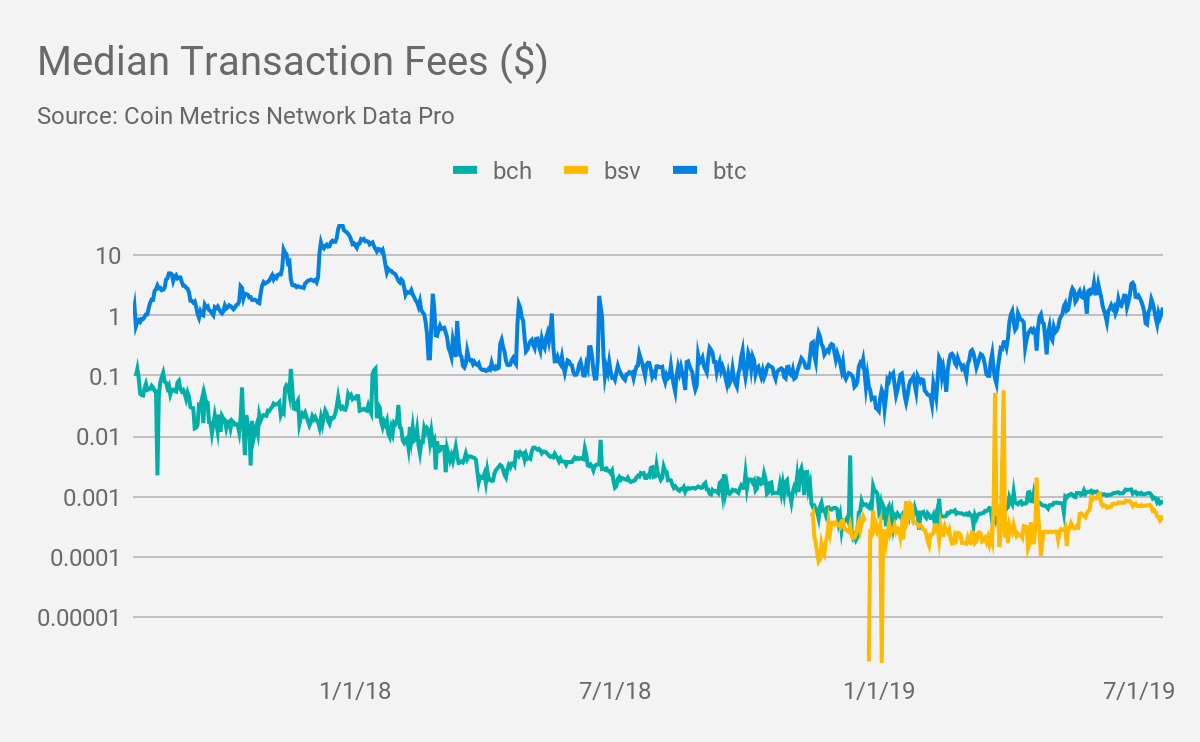

BSV and BCH are both designed to be low fee blockchains. Low fees are an important aspect of medium of exchange tokens, because users are less likely to use an asset for regular payments if they are forced to pay significant fees each time.

BSV and BCH have both had a median transaction fee of $0 for a majority of 2019. BTC’s median fee dipped to as low as $0.03 in early 2019, but has mostly remained between $1 and $3 over the last three months:

But low fees can also be a long-term security risk. Miners are rewarded by a combination of block rewards and transaction fees. Fees become increasingly important as block reward issuance decreases. If total fees are too low, miners may not be incentivized to keep securing the chain after block rewards go to zero.

BTC’s total daily fees regularly top $1M, while BSV and BCH’s total fees have remained below $1,000 a day for the majority of 2019:

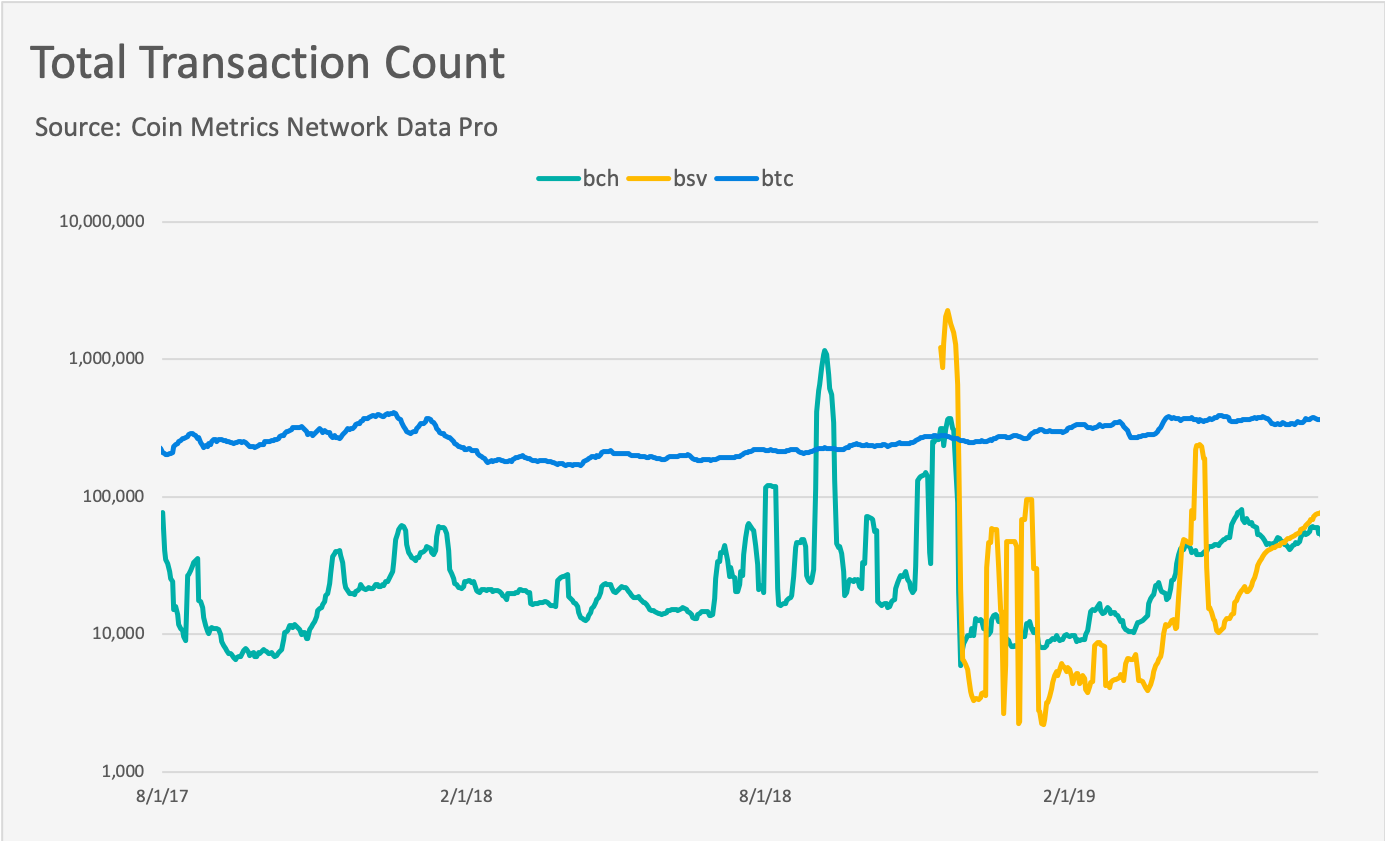

Transaction Count

BTC also has a lead in terms of total transaction count. But BSV and BCH are not quite as far behind. Specifically, BSV has a high number of transactions starting from November 2018 through early 2019. The following chart shows daily total transaction count for each of the three assets on a log scale:

However, a majority of BCH and BSV transactions do not transfer any value. Instead, they store data on the blockchain as part of an OP_RETURN output.

Although blockchains are predominantly used to record value transfers, they can also be used as a distributed, immutable database for non-transaction related data. Short messages (Bitcoin OP_RETURN messages must be less than 80 bytes), like “The weather in New York City on July 15 was 80 degrees,” can be written onto the blockchain and stored forever.

As a result, blockchains can be used as notaries or time stamping services (e.g. Proof of Existence). To do this, users need to create a cryptographic hash (which serves as a unique cryptographical identifier) of a document that they want to timestamp, and include that hash as part of a transaction. The transaction then serves as proof that the document existed at that time, since it is included as part of a specific block on the Bitcoin blockchain. This can then be used to disprove plagiarizers; if someone comes in at a later date and tries to claim that they created the document, the document’s original creator can use their transaction as proof that they already created the document at an earlier date.

To use the blockchain as a database, users need to be able to include arbitrary data as part of a transaction. Bitcoin added the OP_RETURN script opcode in 2013 to allow users to do this. OP_RETURN transactions can be used to record metadata on-chain, but cannot be used to effectively exchange value. Any outputs with OP_RETURN are unspendable.

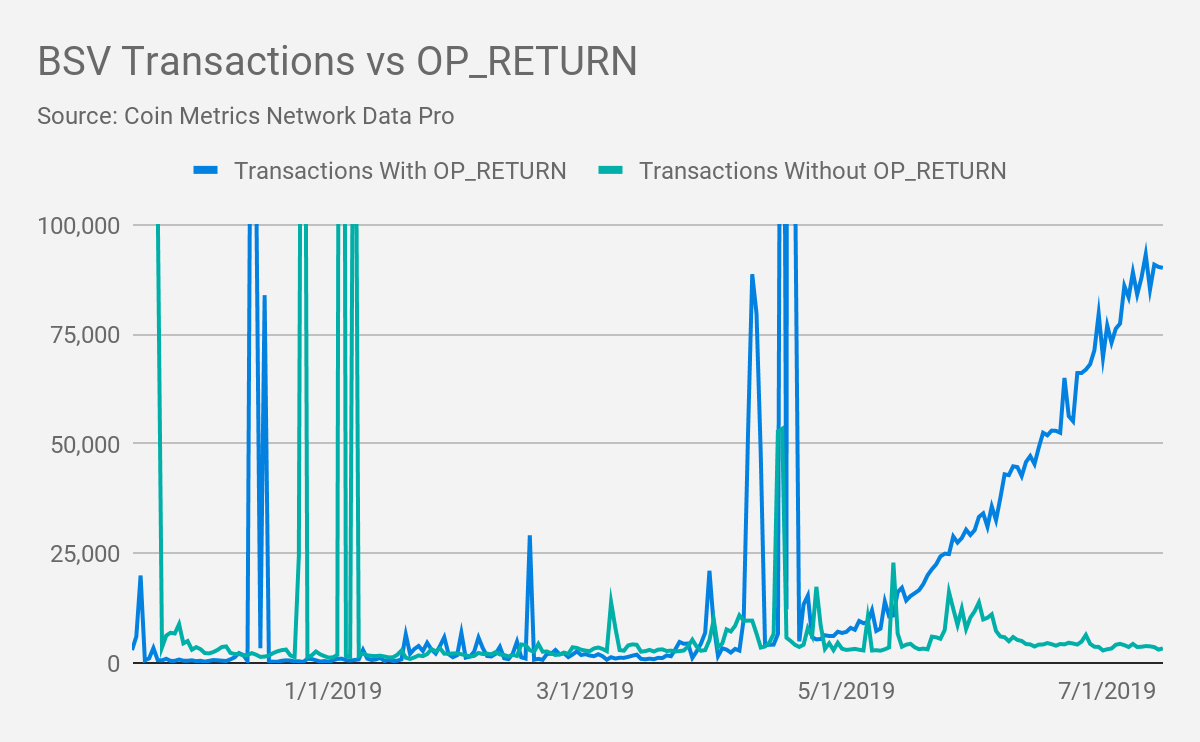

BSV transactions are increasingly including OP_RETURN. The below chart shows the daily count of BSV transaction with OP_RETURN, vs BSV transactions without OP_RETURN:

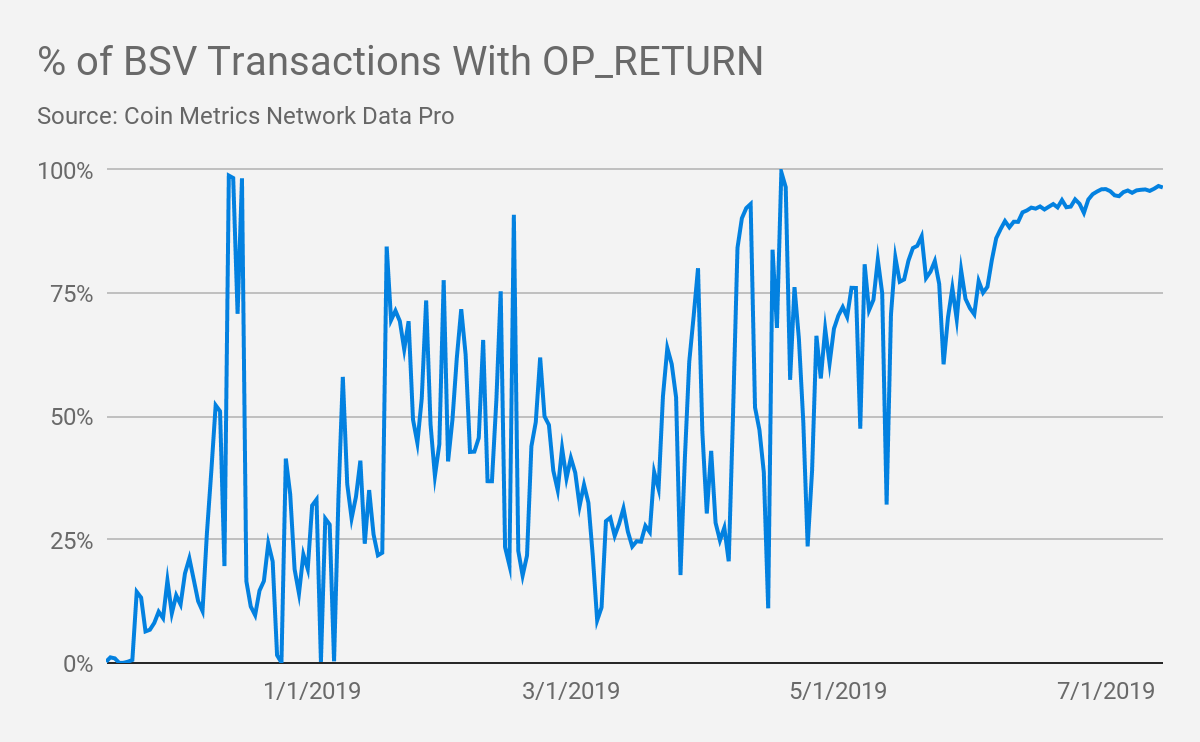

As of July 1st, over 94% of daily BSV transaction include an OP_RETURN:

Any app or user can use OP_RETURN to arbitrarily record data, for a variety of different reasons. A large portion of BSV’s OP_RETURN transactions, for example, come from a weather app called “WeatherSV.” WeatherSV records and retrieves climate data on the BSV ledger. According to the WeatherSV website, a weather channel “can be activated for $5 AUD and includes approximately 142 days of hourly broadcasts, based on current fees.”

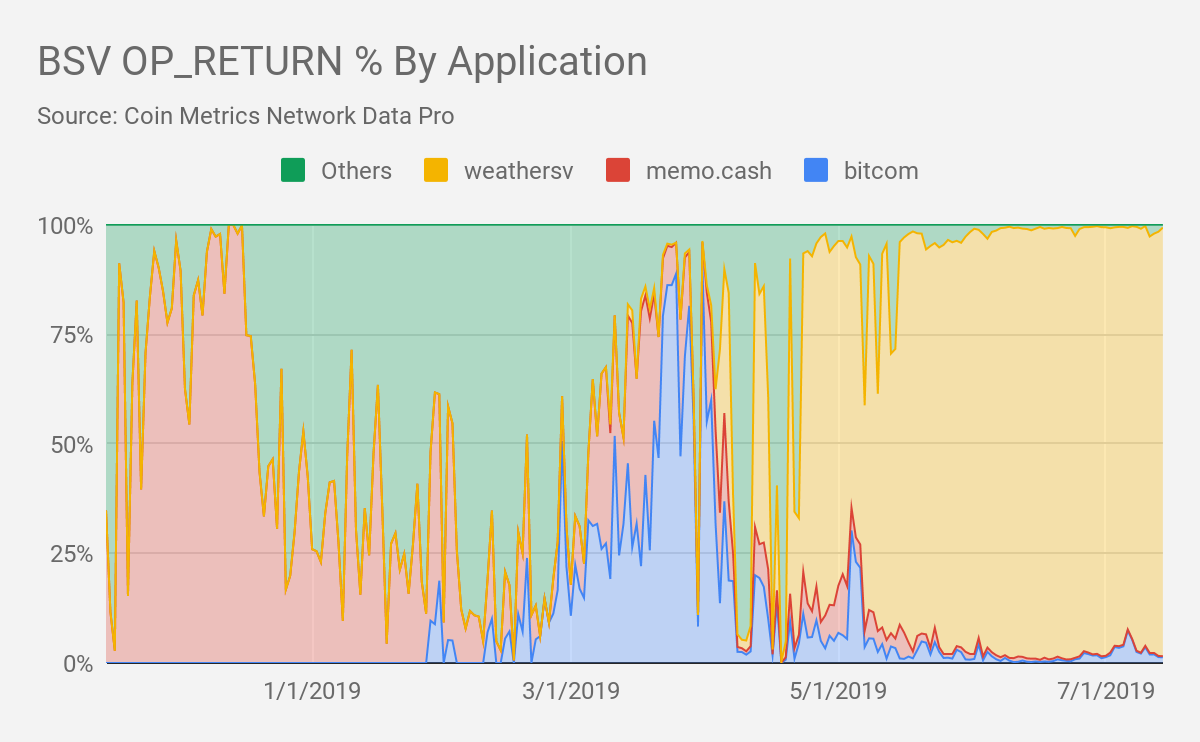

The following chart shows the percent of total BSV OP_RETURN transactions sent by individual applications. Since May, a majority of BSV OP_RETURN transactions have been sent by WeatherSV:

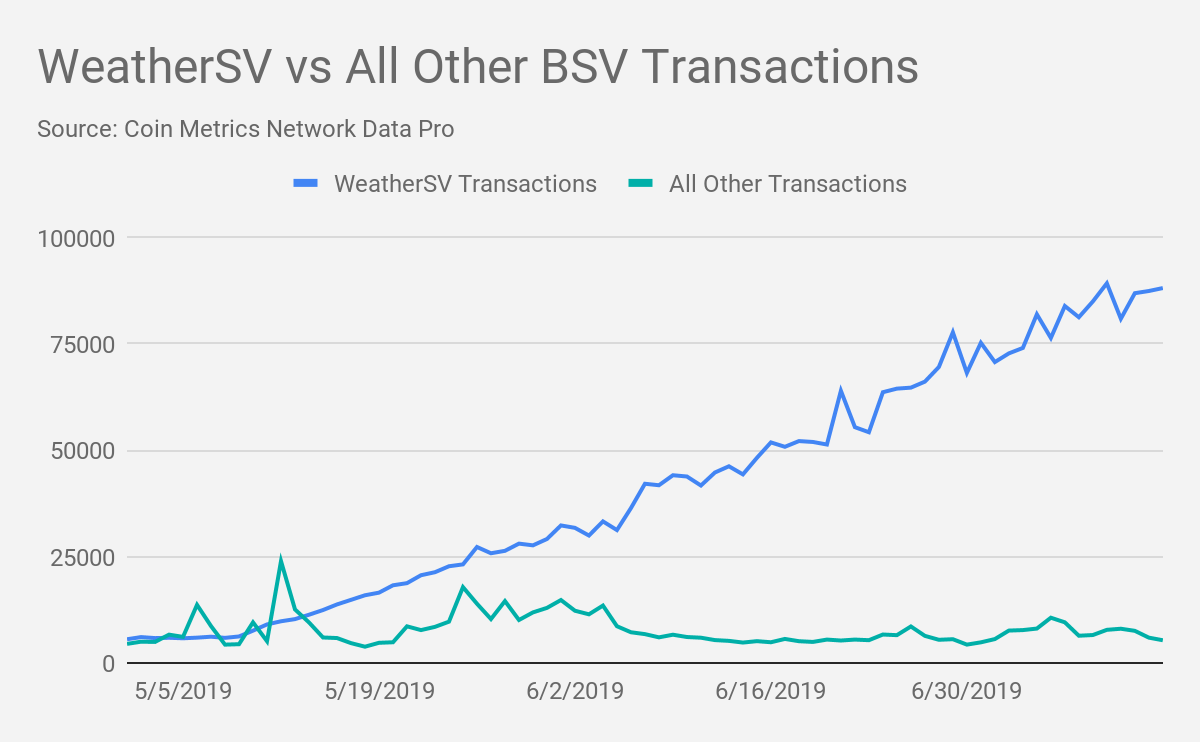

In fact, a majority of BSV’s overall transactions (including transactions with and without OP_RETURNS) are now coming from WeatherSV. As of July 14th, over 94% of all BSV transactions are being sent by WeatherSV:

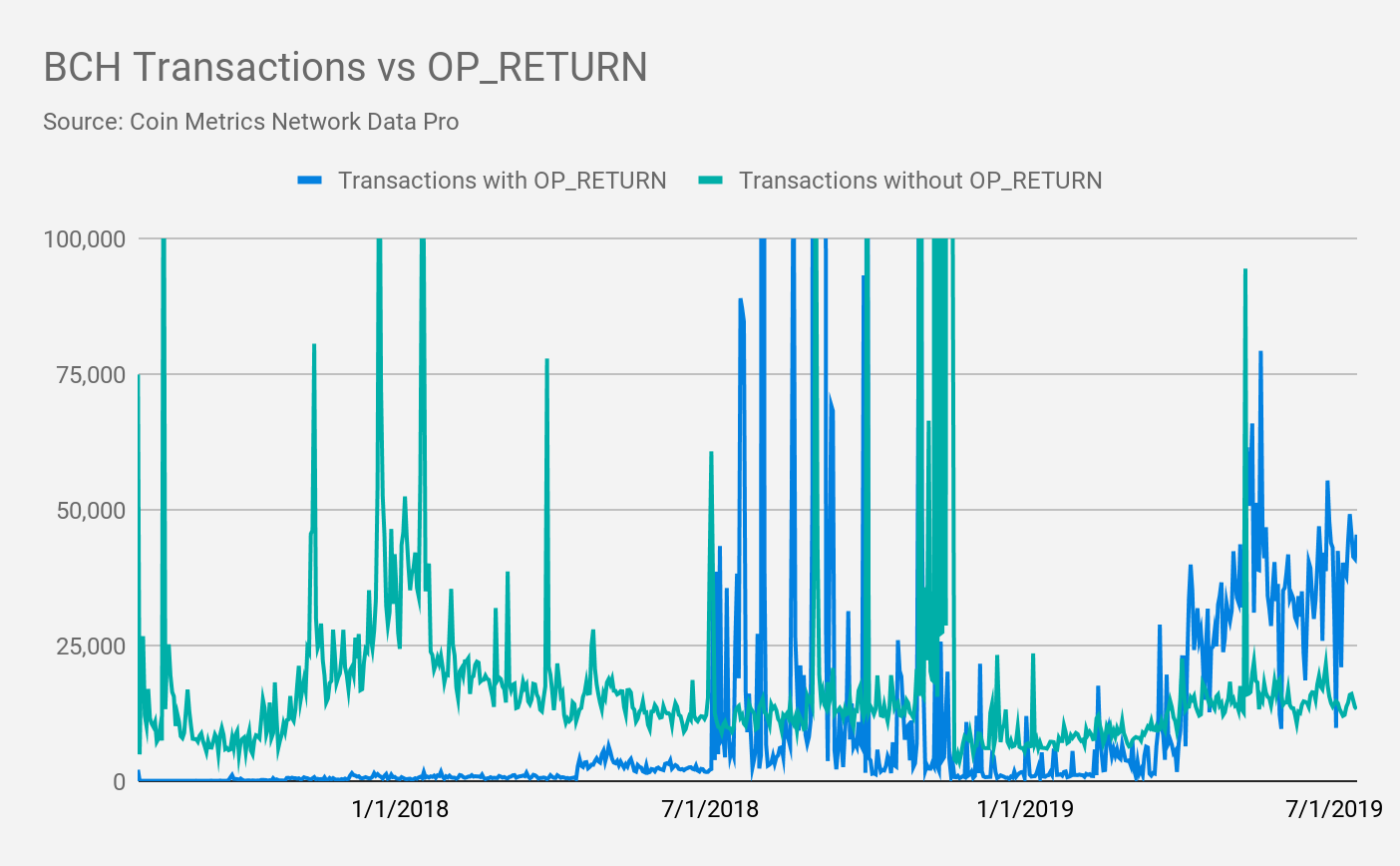

Similarly, BCH is increasingly trending towards transactions with OP_RETURN. The following chart shows the daily count of BCH transaction with OP_RETURN, vs BCH transactions without OP_RETURN:

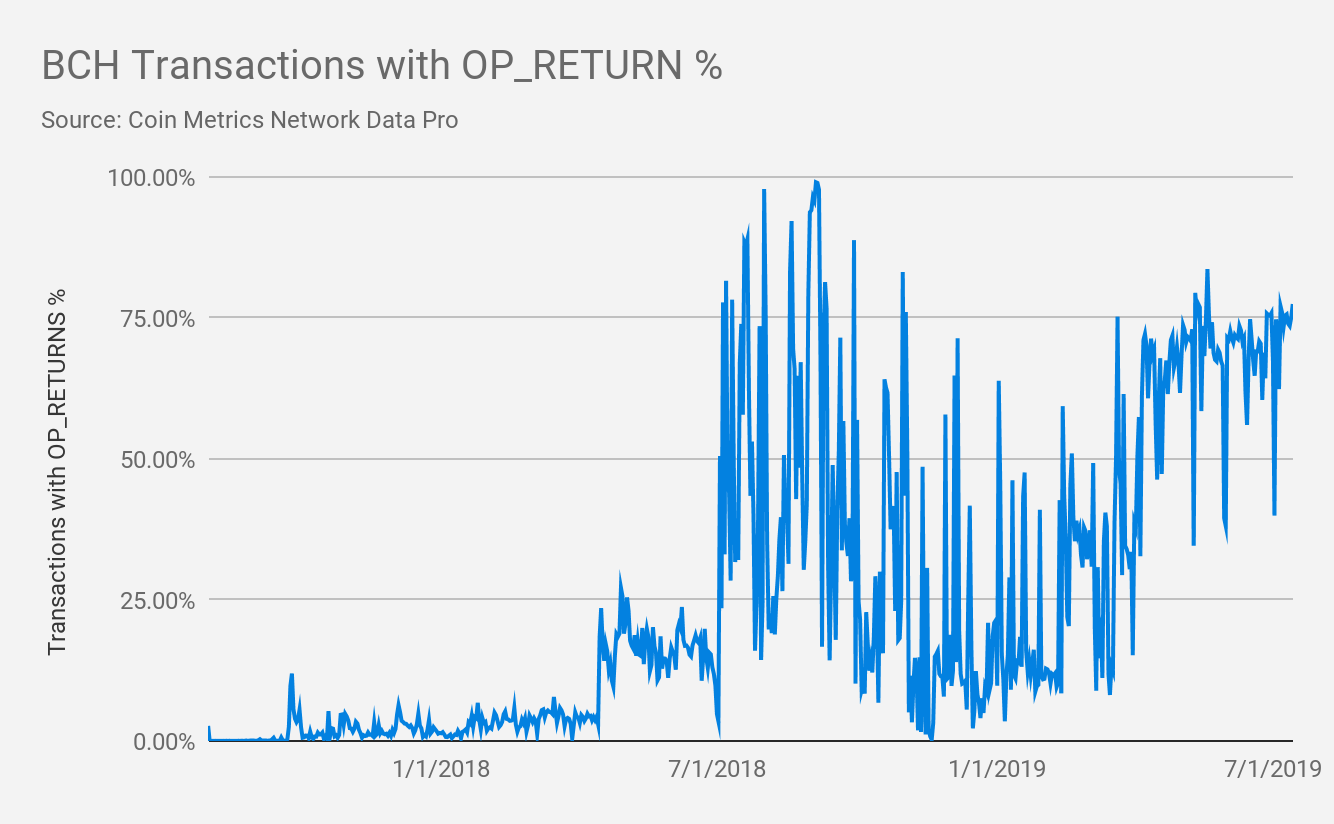

As of July 1st, over 67% of daily BCH transaction include an OP_RETURN:

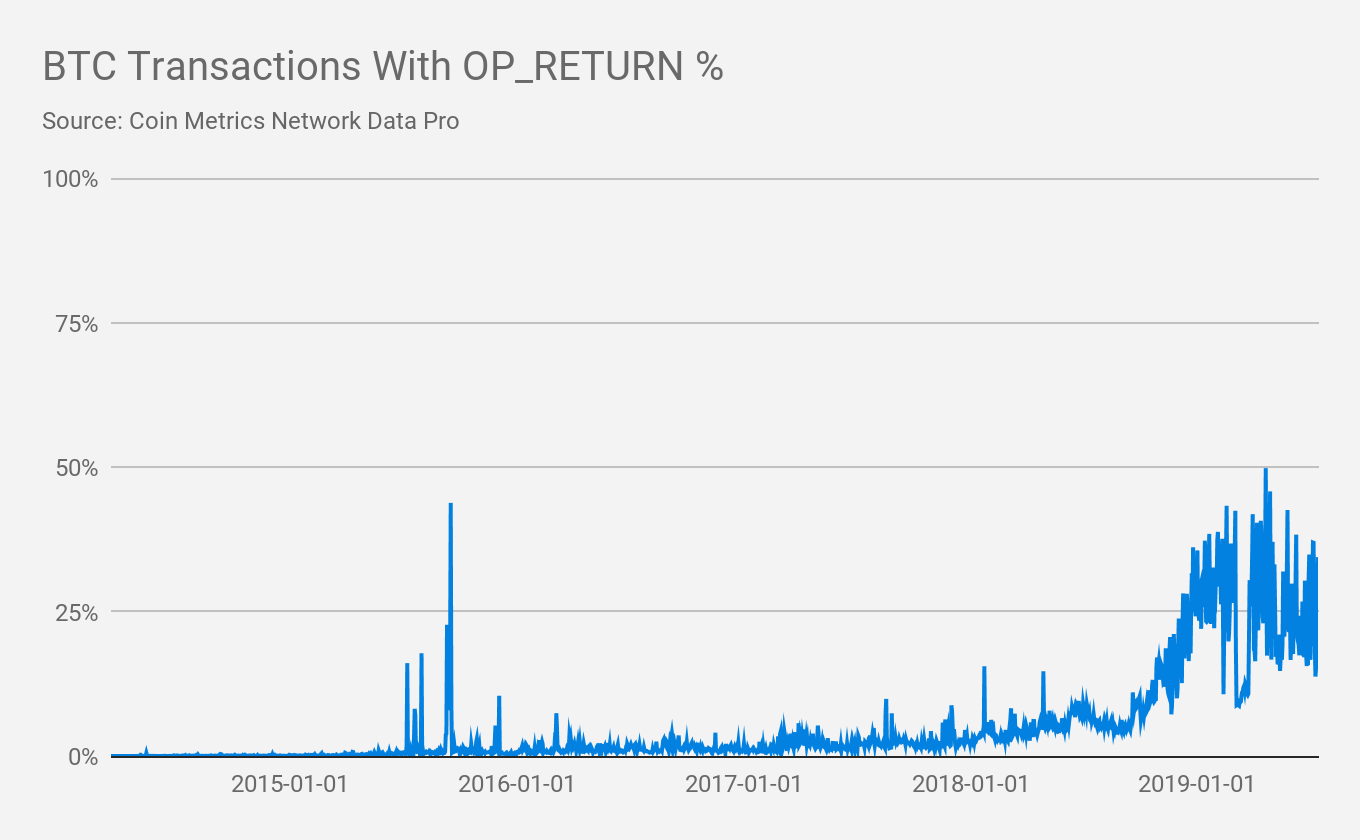

Comparatively, only about 25% of BTC transactions include an OP_RETURN:

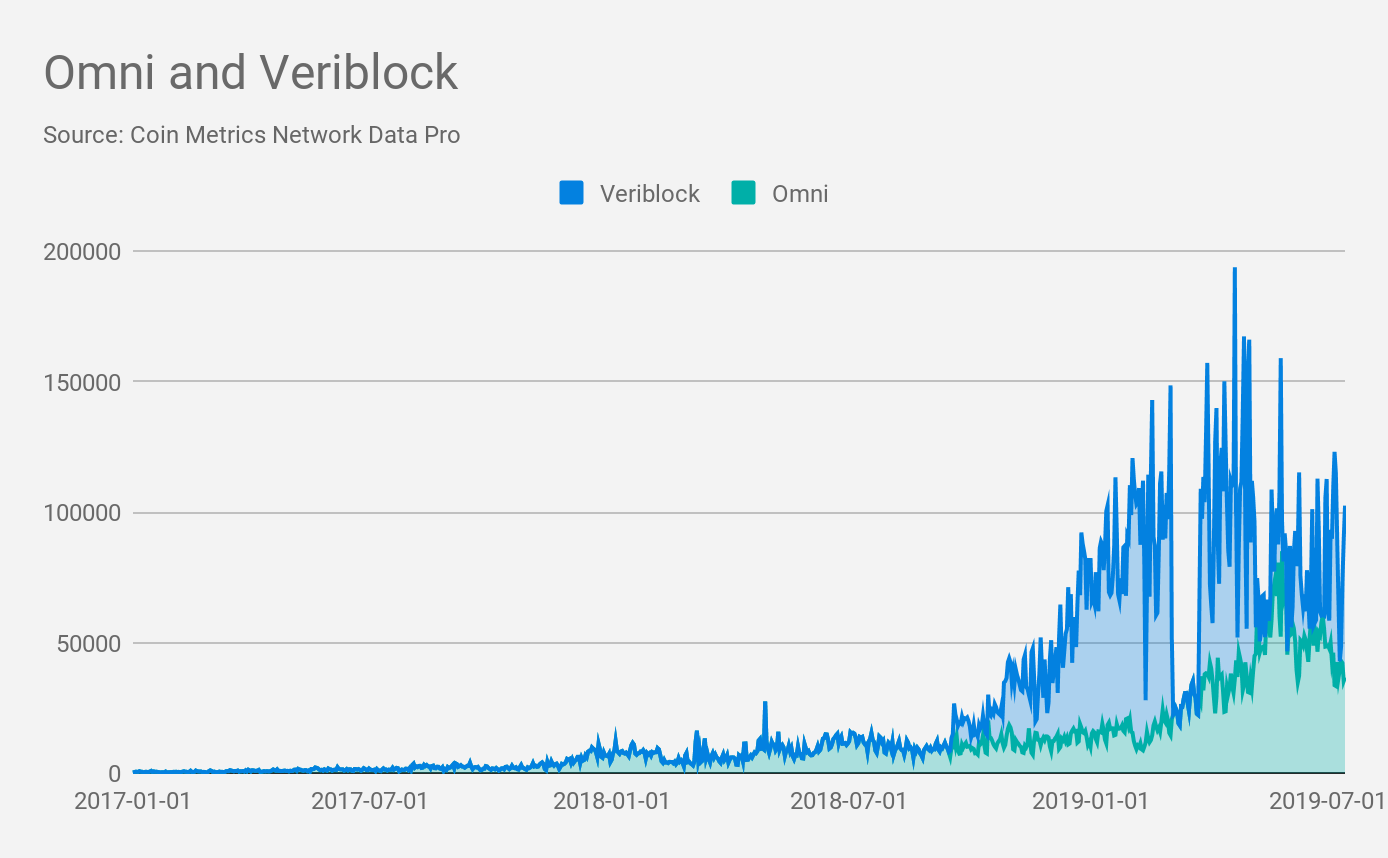

A majority of BTC’s OP_RETURN transactions come from Omni and Veriblock. The below chart shows OP_RETURN transaction count for each:

Relative to BTC, BSV and BCH are increasingly being used as a way to store data, as opposed to as a medium of exchange. Additionally, BCH or BSV could potentially become a data storage layer for other blockchains, as recently proposed by Ethereum’s Vitalik Buterin.

Adjusted Transfer Value

Total value transferred gives an approximation of total goods exchanged. We define value transfer as “movements of native units from one ledger entity to another distinct ledger entity.” Only transfers that are the result of a transaction and that have a positive (non-zero) value are counted. Total transfer value therefore serves as a proxy for total economic activity.

However, it’s not a perfect measure; not every value transfer is necessarily a true exchange of economic goods. For example, many transfers are due to users cycling assets between various addresses that they own.

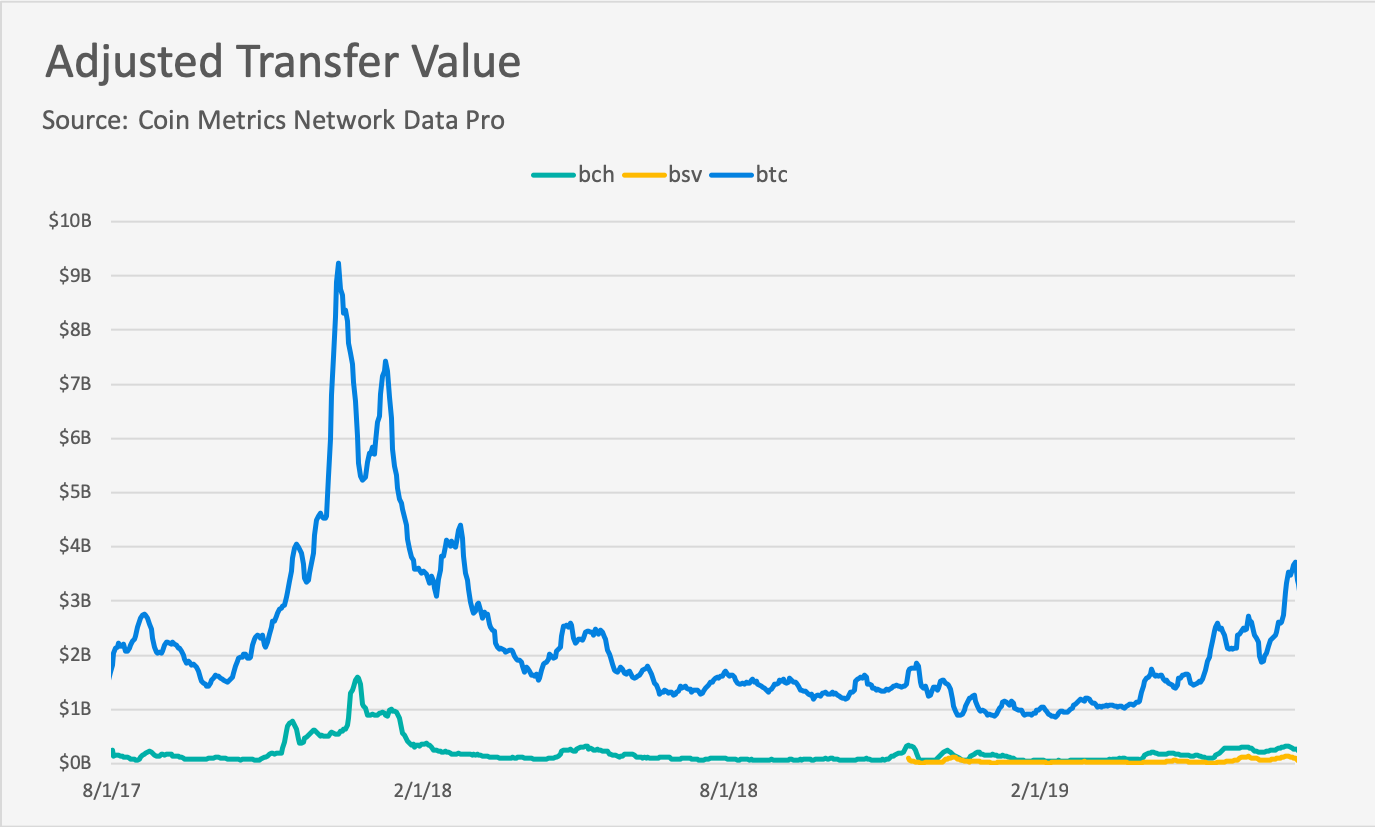

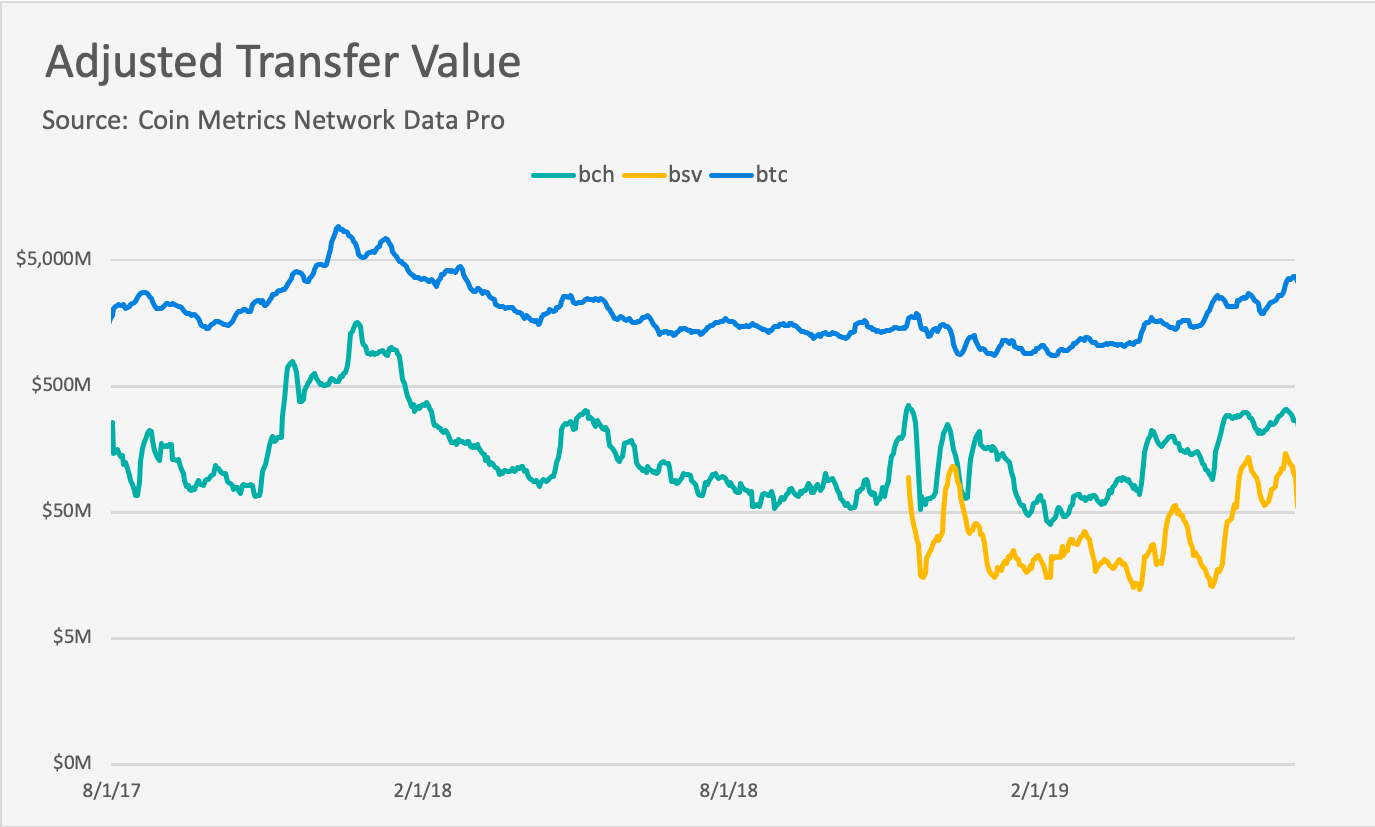

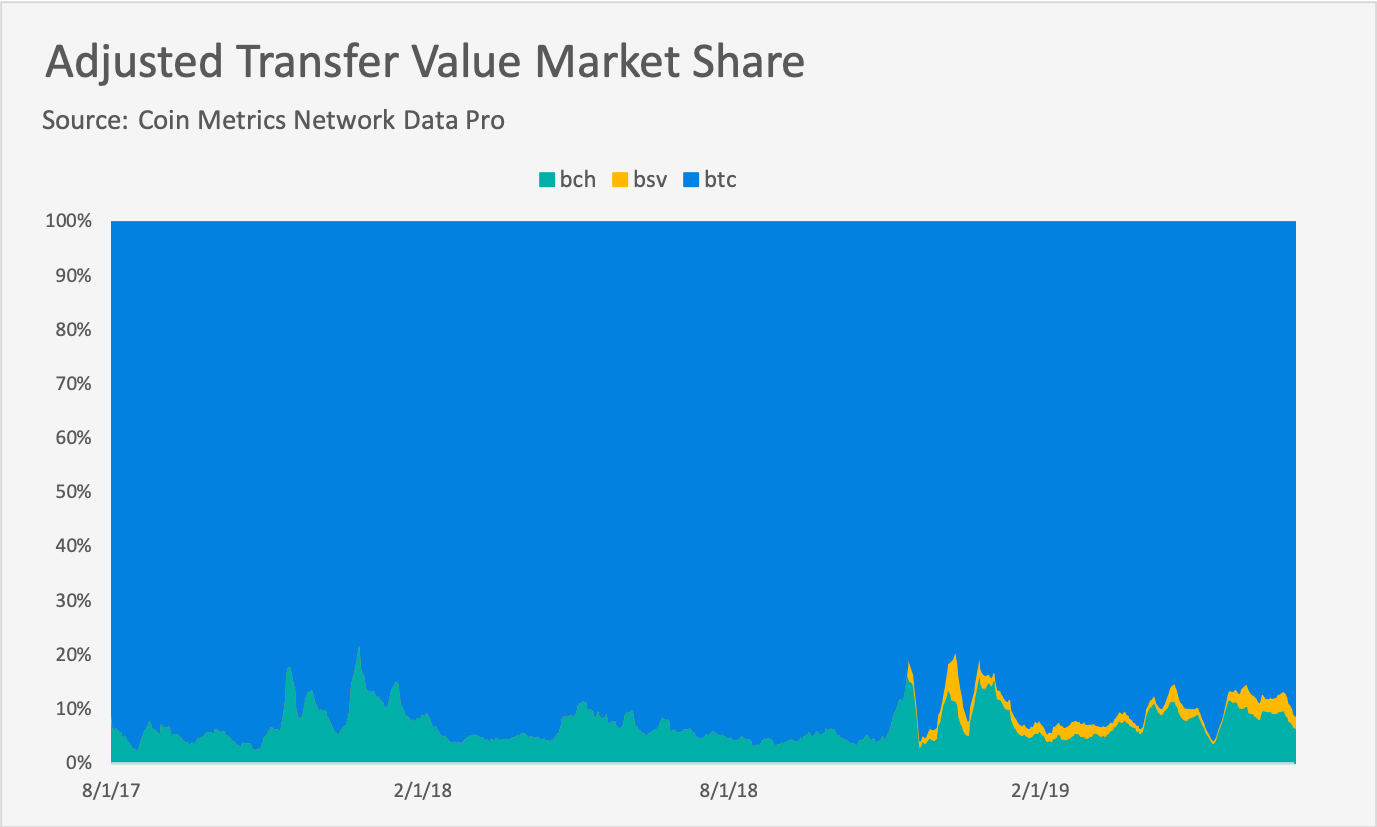

To account for this, we use a metric which we call ‘adjusted transfer value,’ which attempts to remove non-economic activity and other artifacts like self-sends and deliberate spamming. BTC dominates in terms of total amount of value transferred. The below chart shows total adjusted transfer value for BTC, BSV, and BCH:

BSV and BCH’s adjusted transfer value have both been growing. BSV’s 2019 daily adjusted transfer recently value peaked at $144.2M on June 26th, 2019, while BCH reached its 2019 peak of $325.5M on June 27th, 2019. However, this is still orders of magnitude less than BTC, which reached $3.58B daily adjusted transfer value on June 20th, 2019.

During the month of June, BTC had over 85% of the total market share (between the three assets) of adjusted transfer value, as seen below:

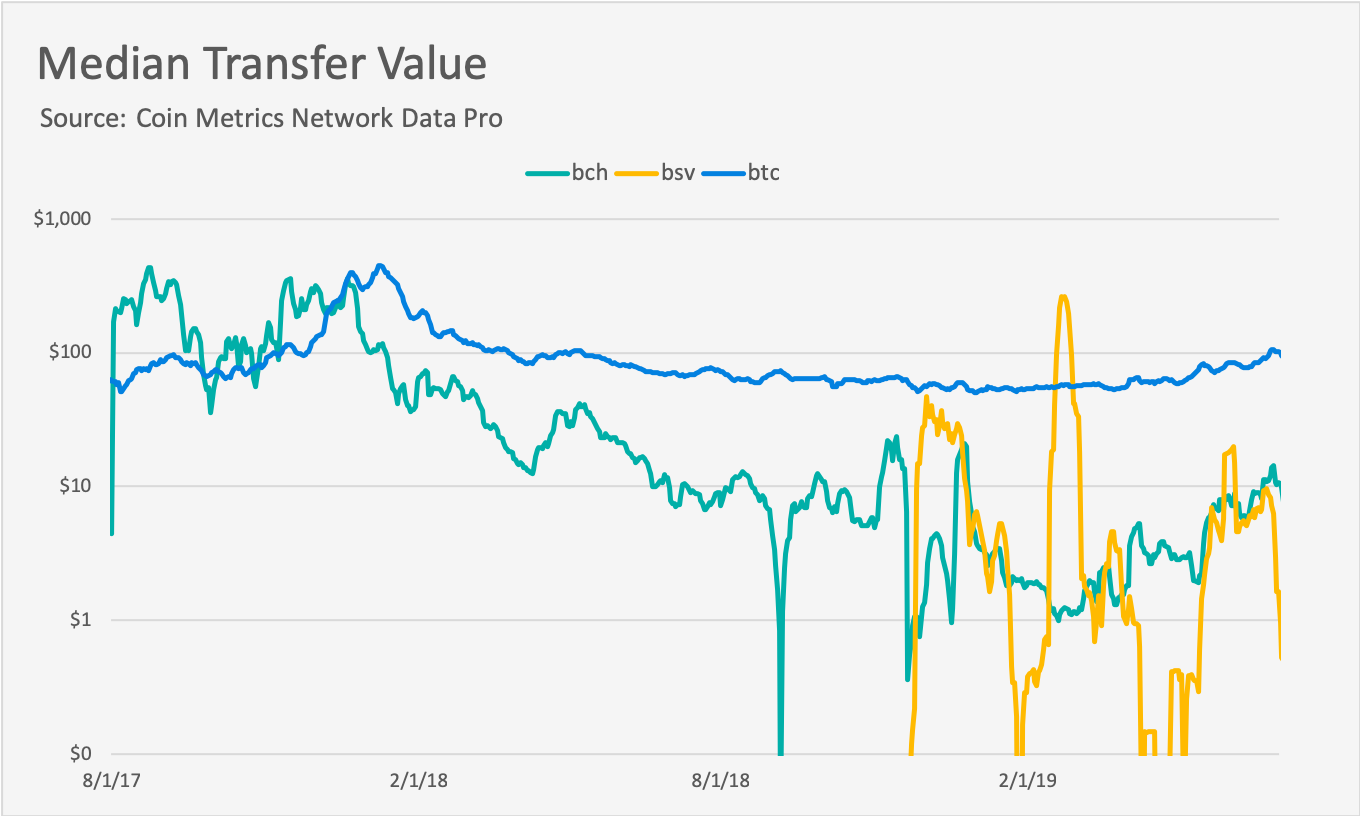

Median Transfer Value

BTC’s median transfer value is also significantly higher than both BCH and BSV. While BTC’s median transfer value has fluctuated between $50 and $100 USD over the course of 2019, BSV and BCH’s median transfer value has mostly stayed between $1 and $10. BSV, in particular, has been relatively volatile over the past few months, dropping to a median transfer value of $0 on several separate days:

A larger total transfer value or median transfer value doesn’t necessarily mean that an asset is being used more as a medium of exchange while another is not; perhaps BSV is being used for small exchanges and/or microtransactions (similar to Kin, which we investigated in a previous research report), while BTC is being used to exchange more valuable goods and services. But it will be an important metric to monitor moving forwards, as it can shed more light on what these assets are actually being used for.

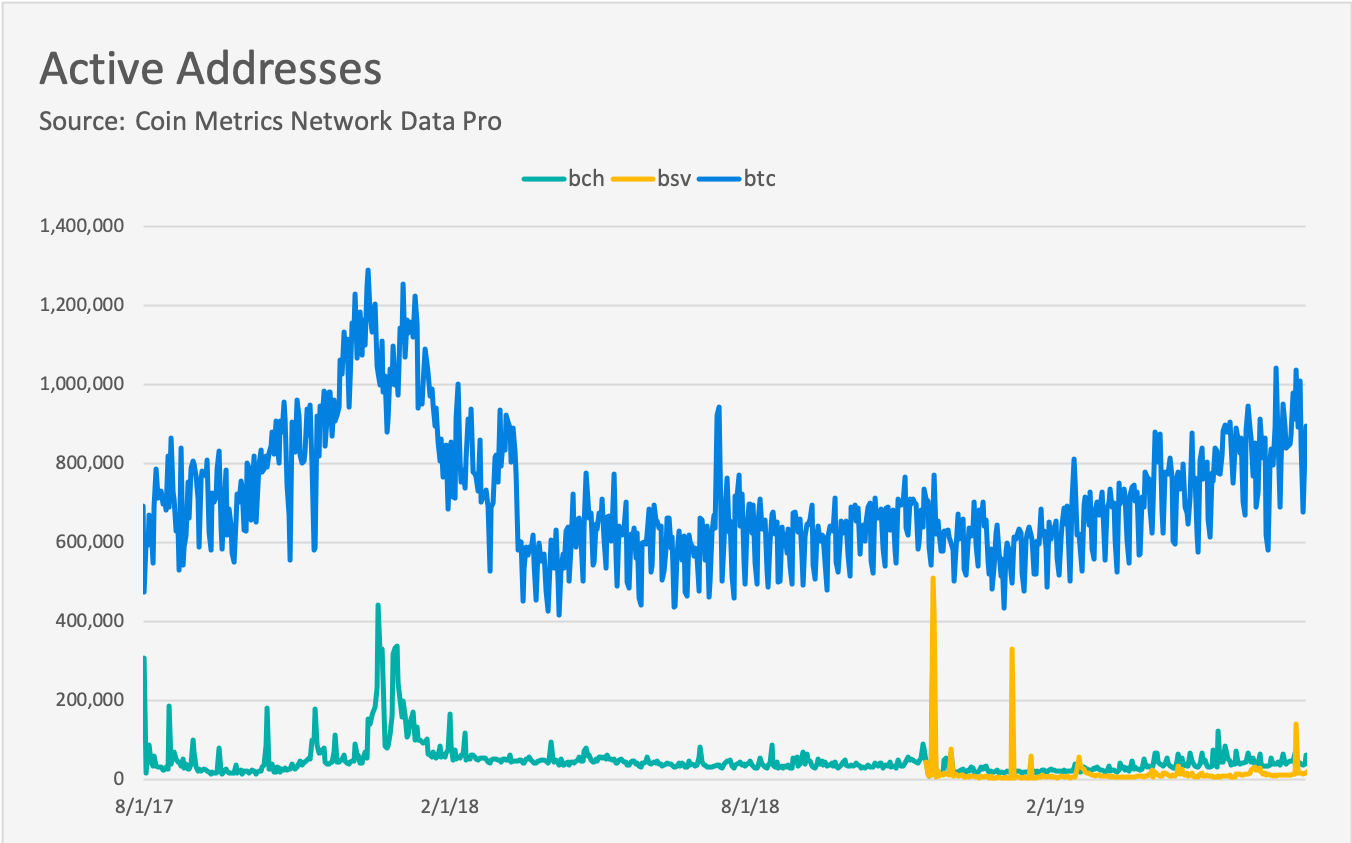

Active Addresses

Active addresses are a way to get an approximate measure of the total number of unique people using a crypto asset. We define “active addresses” as the count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that day. Active addresses represent a maximum number of potential daily unique users, assuming that each user needs at least one address. However, it’s important to note that many users control multiple addresses, which means the actual amount of unique users may be significantly lower than the total amount of unique addresses. Addresses can be one person to many addresses or many people to one address (like an exchange wallet).

BTC once again dominates in terms of active addresses. The below chart shows daily active addresses on a log scale. While BTC has fluctuated between 600,000 and 1,000,000 daily unique active addresses for most of 2019, BCH and BSV have remained below 100,000 and 50,000, respectively (outside of a few outliers):

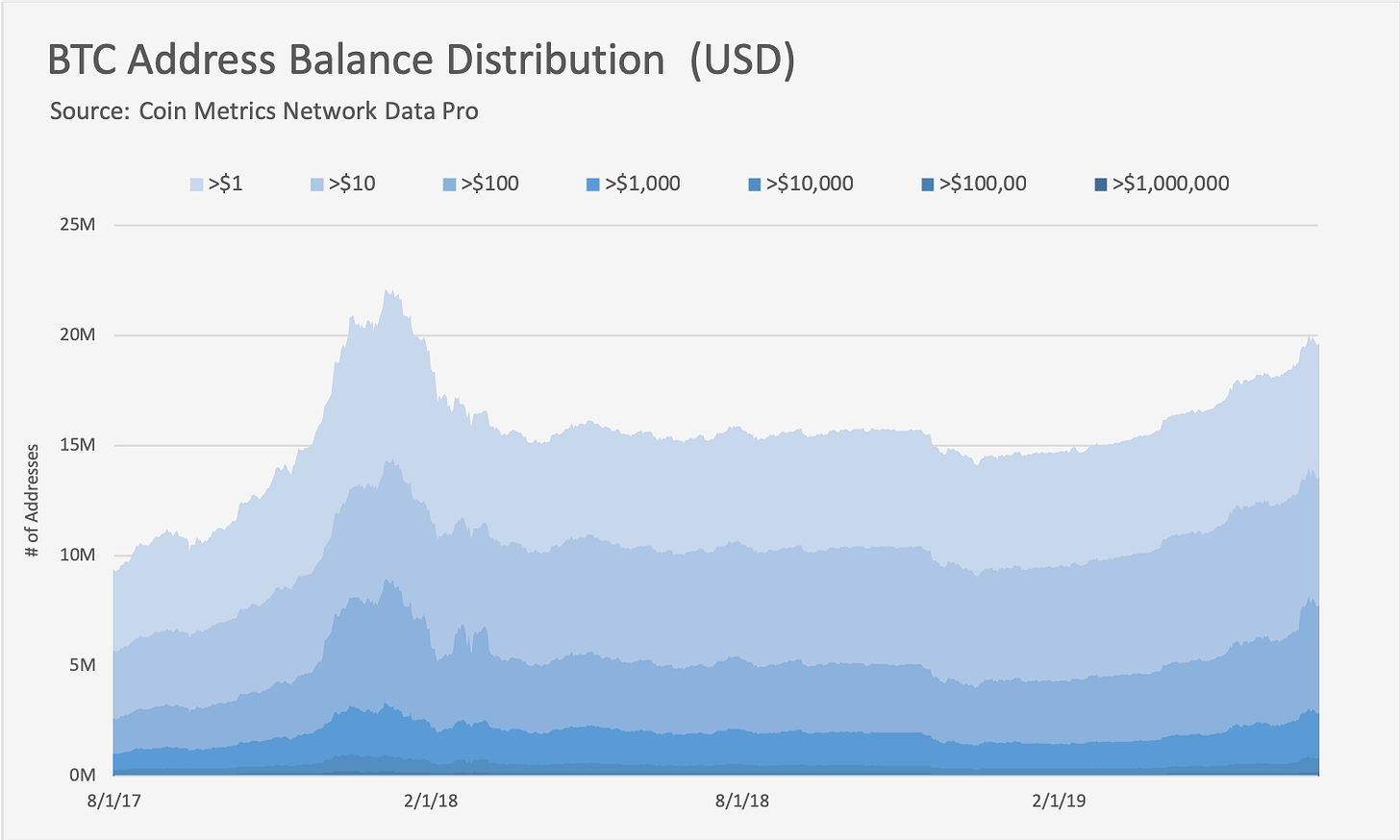

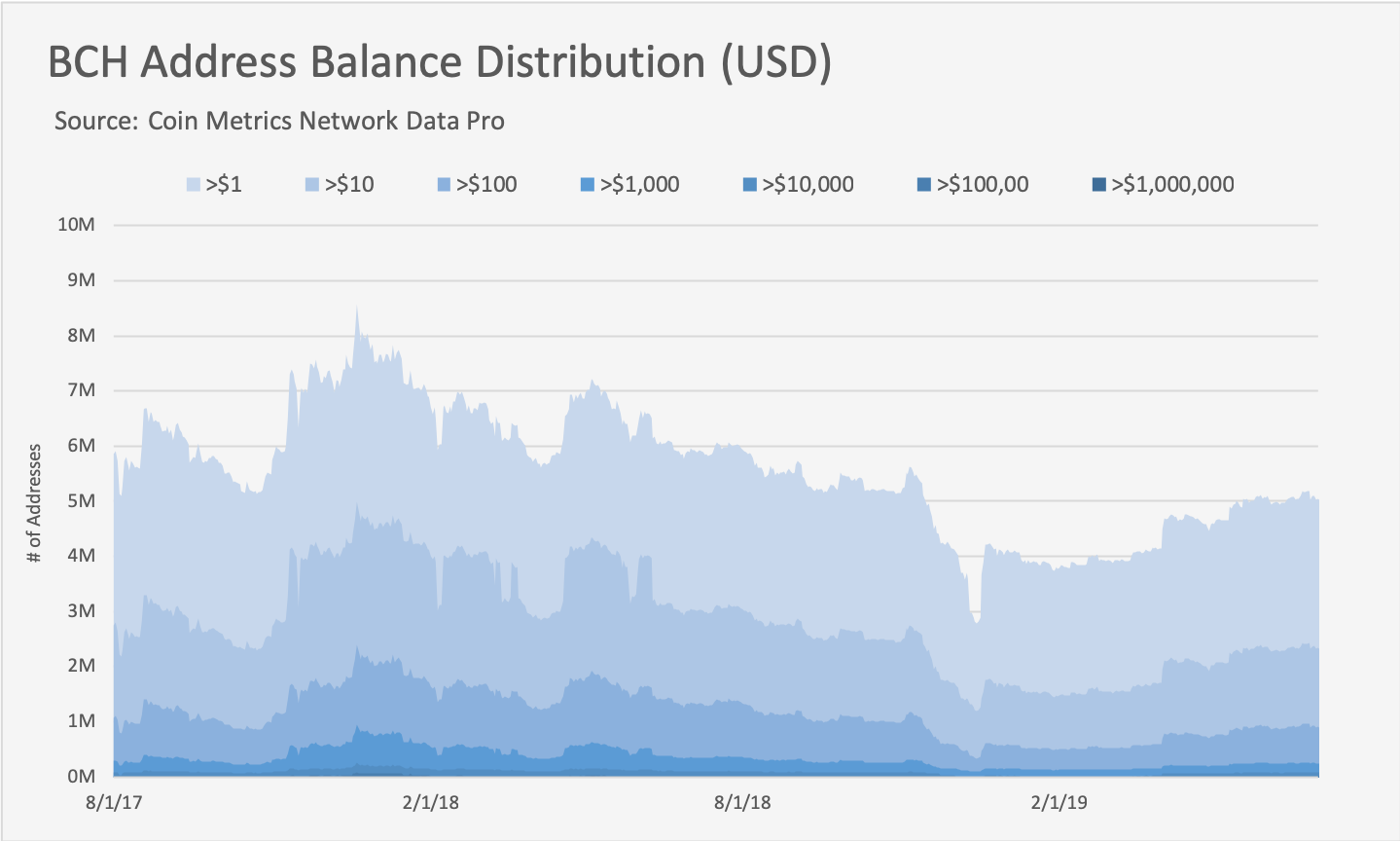

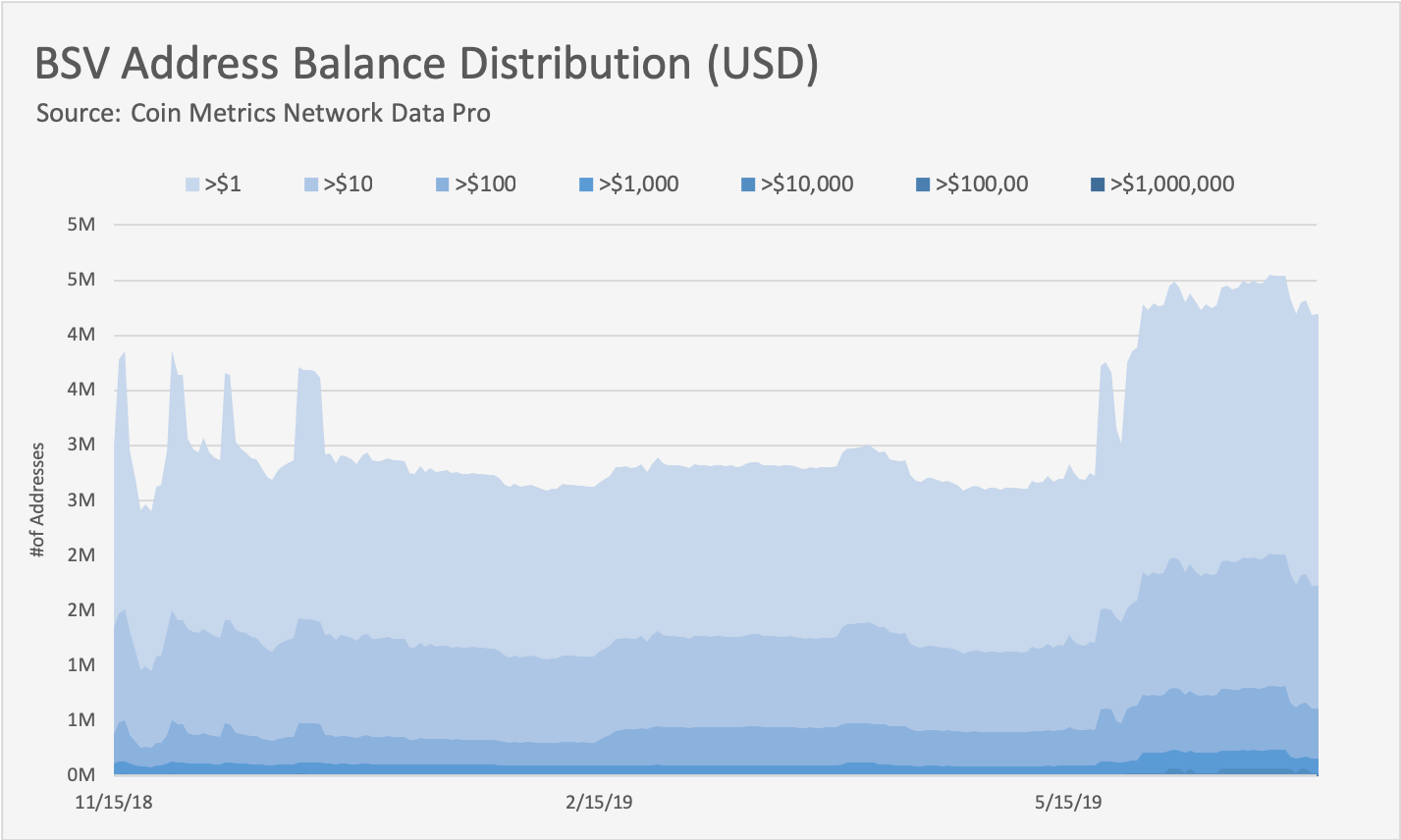

Address Balance Distribution Bands (USD)

Address balance distribution bands show the count of unique addresses holding a specific amount of dollars worth of currency at the end of that day.

This metric also represents a proxy of potential unique users, again assuming that each user needs at least one address holding a non-negligible amount of value. BTC is approaching 20M unique addresses with at least $1 (and growing), while as of July 1st BCH and BSV had 5.05M and 4.19M, respectively

The below charts show the amount of unique addresses holding at least $1, $100, $1k, $10k, $100k, and $1M:

Medium of Exchange Summary

Although BSV and BCH have some of the desirable features of a medium of exchange asset, like low fees, this has not yet led to a large increase in activity as compared to BTC. Both BCH and BSV still only have a small fraction of the usage of BTC when measured by metrics like adjusted transfer value and active addresses.

Furthermore, BSV and BCH are increasingly being used as ways to store data on chain, and not as a medium of exchange. BSV, in particular, is predominantly being used as a way to record data on-chain, with over 94% of transactions containing OP_RETURN, a majority of which come from a single weather application. BSV may ultimately be used as a data storage blockchain, likely due to their removal of the size restriction on OP_RETURN transactions.

As of now, BCH and BSV are not gaining real usage over BTC as a medium of exchange. It remains to be seen whether they can take more of BTC’s market share moving forward.

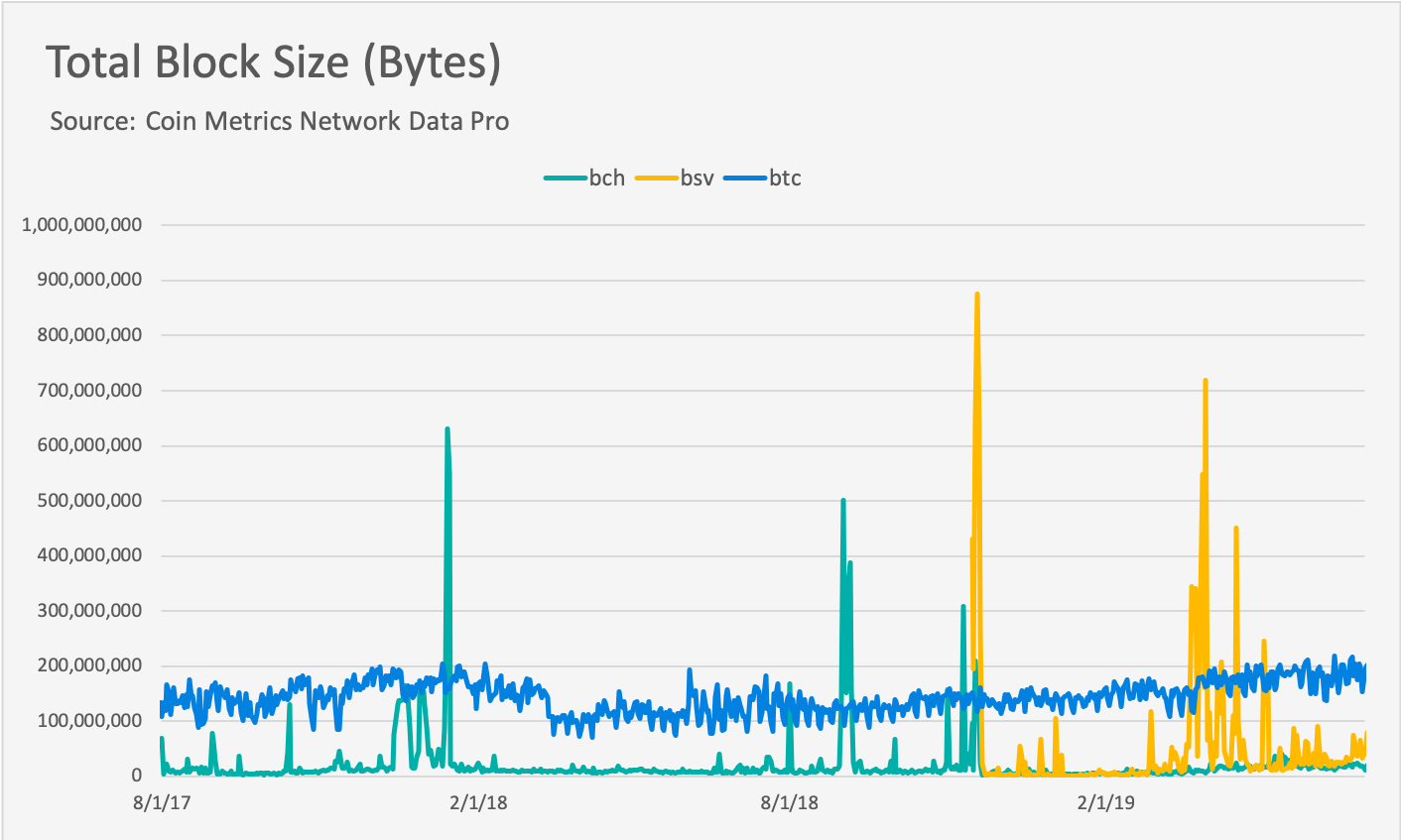

Block Size Analysis

Block size was a main point of contention for both the BCH and BSV fork. After much debate, BCH increased block size to 32MB, and BSV increased it once again to 128MB. Theoretically, bigger block size allows for more transactions per block. But is this increased block size being utilized? In this section, we analyze various metrics related to block size and block fullness.

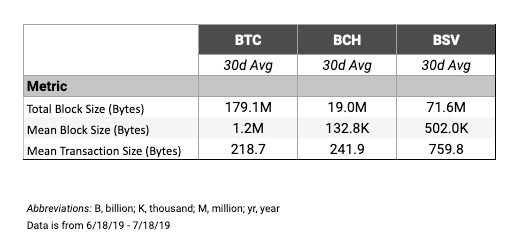

Total Block Size (Bytes)

In terms of total block size, BTC still leads both BSV and BCH, despite having a smaller maximum block size. The below chart shows total block size (the sum of the size, in bytes, of all blocks created) on a daily basis. Much of BSV’s total block size is due to the proliferation of transactions with OP_RETURN, as noted in the “medium of exchange” section.:

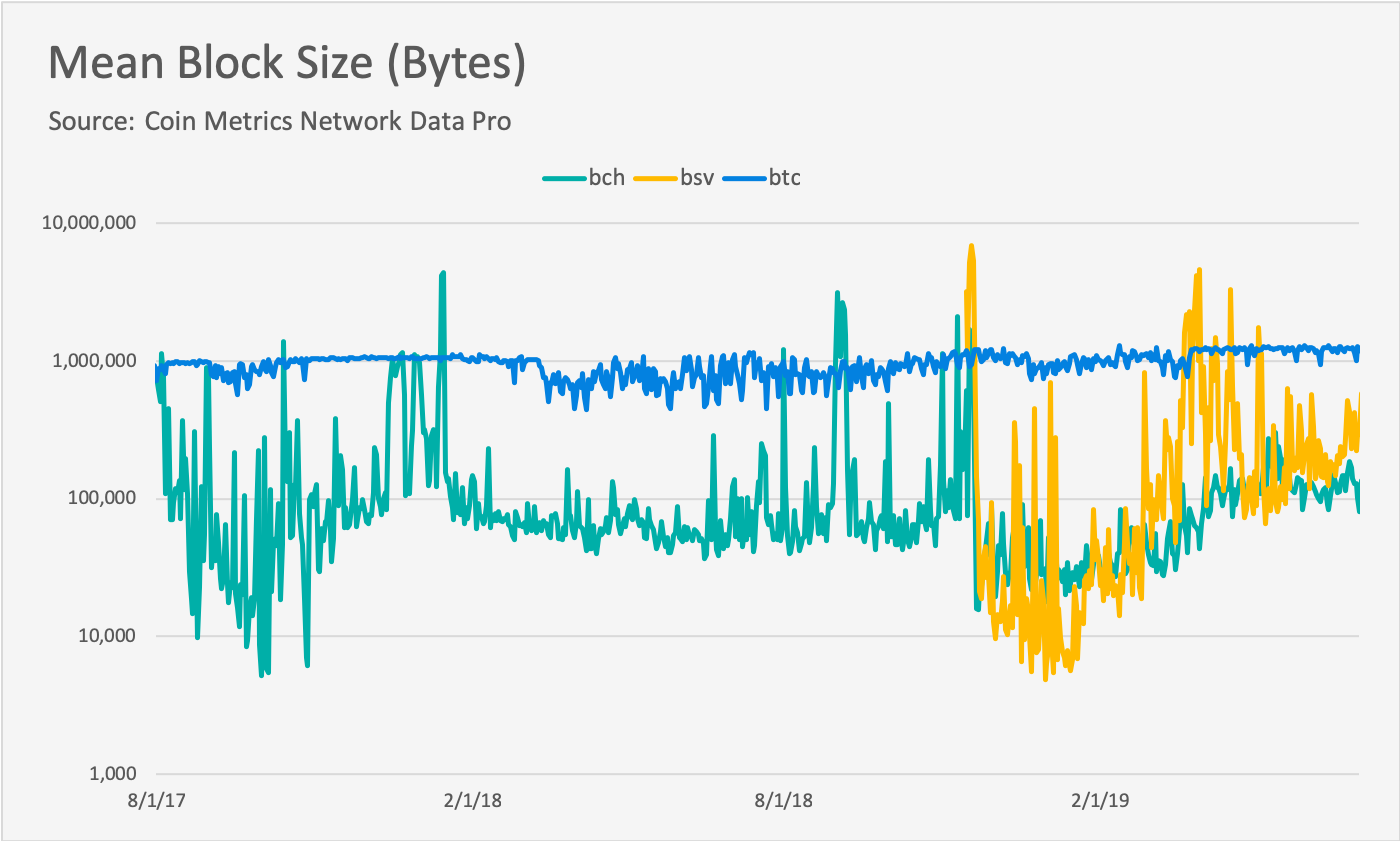

Mean Block Size (Bytes)

BTC also leads both BSV and BCH in terms of mean bytes per block. While BTC has consistently remained around an average of 1MB per block, BSV and BCH have for the most part remained well below the 1MB per block threshold. BSV has had full blocks, but has not yet had consistently full blocks over the course of a day.

Full BSV blocks also led to several orphanings. Orphan blocks are valid blocks that do not end up getting included in the main chain. Orphan blocks occur when multiple miners successfully mine a new block at approximately the same time. One of the blocks gets accepted to the blockchain, while the other is “orphaned,” and does not get accepted. This is exacerbated by larger blocks, because larger blocks take significantly longer to propagate and validate, which can lead to miners getting out of sync. In April, 2019, six consecutive BSV blocks were orphaned, which included a 128 MB block.

Both BSV and BCH have occasionally surpassed a 1MB per block daily average, as seen in the below chart (on a log scale):

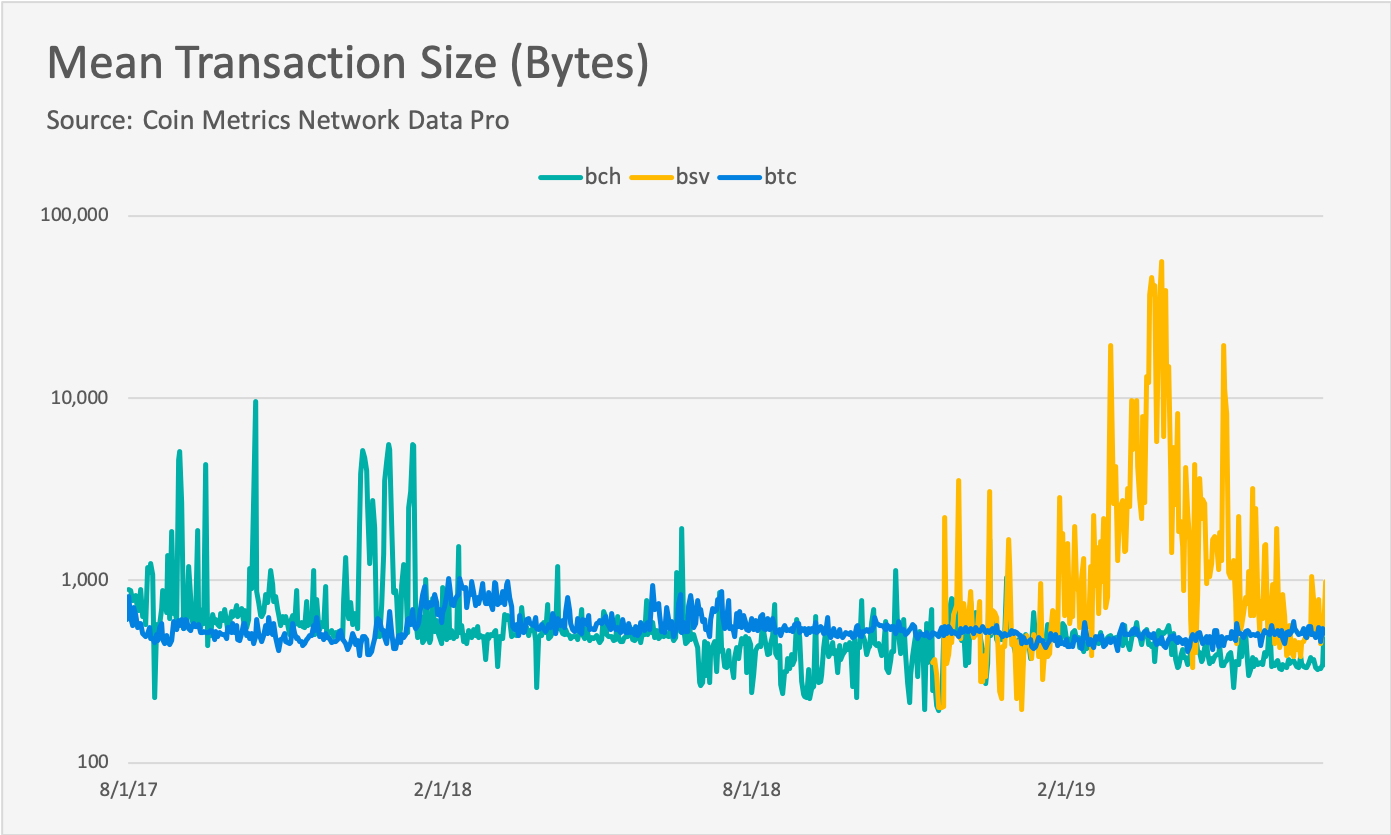

Mean Transaction Size (Bytes)

Broken down by individual transactions, BSV actually has more mean bytes per transaction than both BCH and BTC. This again is most likely related to OP_RETURNS; many BSV transactions contain arbitrary data, which increases the overall transaction size:

Block Size Summary

Although both BCH and BSV have larger maximum block sizes than BTC, they have not yet utilized that extra space. For the most part, BCH and BSV’s daily average block size has remained well below BTC’s 1MB average.

Both BSV and BCH have had blocks that have exceeded BTC’s largest blocks. BSV blocks, in particular, are increasingly being filled by OP_RETURN transactions, as alluded to in the “medium of exchange” section.

BSV and BCH’s increased block size may become a factor if either gain adoption as a data storage blockchain. But it does not appear to currently be a factor in terms of being used as a medium of exchange.

Security and Mining; Impact of Hash Rate

Network security is arguably the most important consideration for any blockchain. A major security failure has the potential to destroy a crypto asset’s value in a very short period of time. In this section we analyze metrics like hash rate and total mining revenue, to measure the security of each of the three crypto networks.

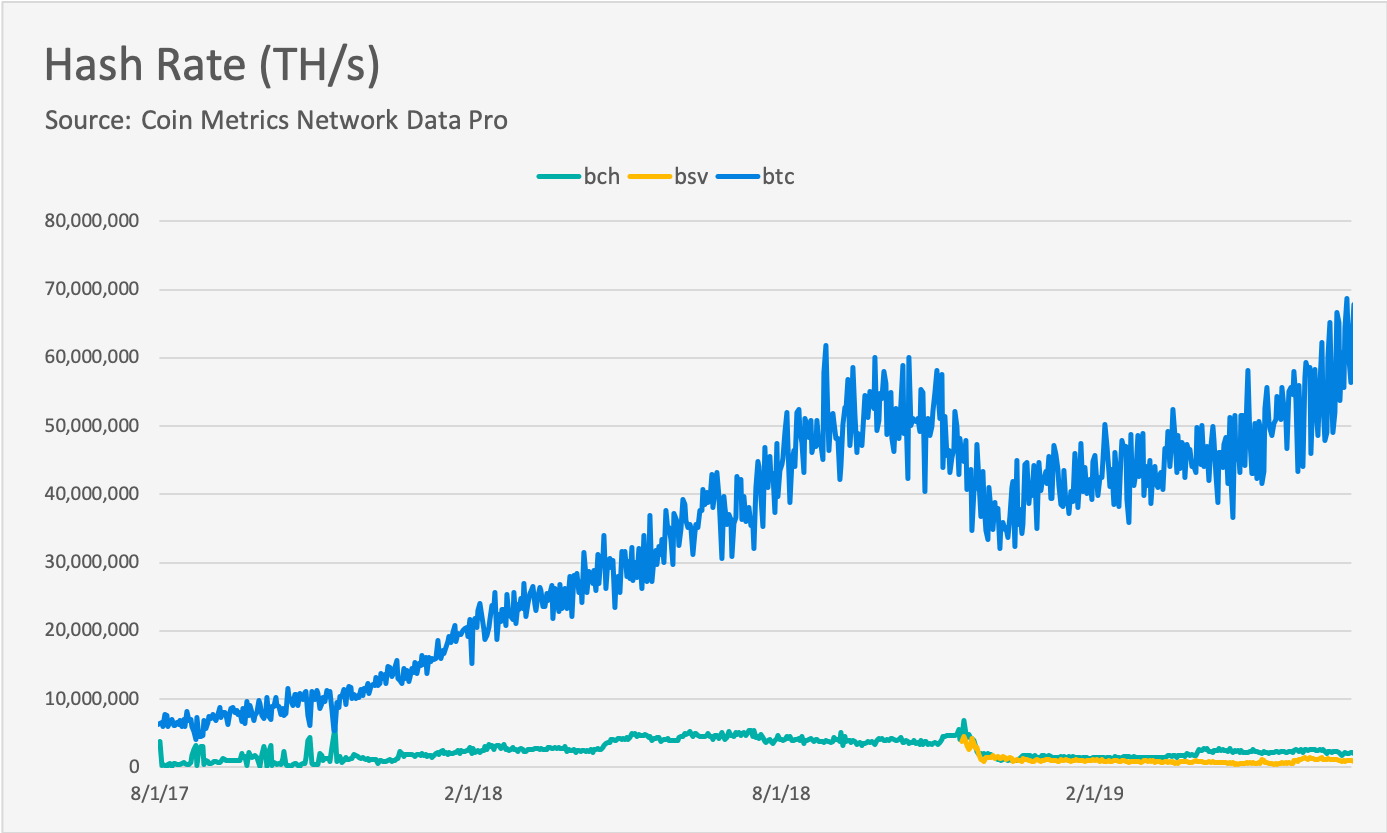

Hash Rate

When blockchains go through a contentious hard fork (where the hashing algorithm stays the same for both off-shoots), their hash rate is inevitably affected. Hash rate is the speed at which proof of work computations are being completed across all miners in the network, and serves as a proxy for energy expenditure. Miners choose whether to stay on the original chain, or to leave and start mining the new forked chain. Hash rate increases as more miners join the network, and when more powerful mining hardware is used. Conversely, it decreases if miners leave the network and are not replaced by either new miners or more efficient hardware.

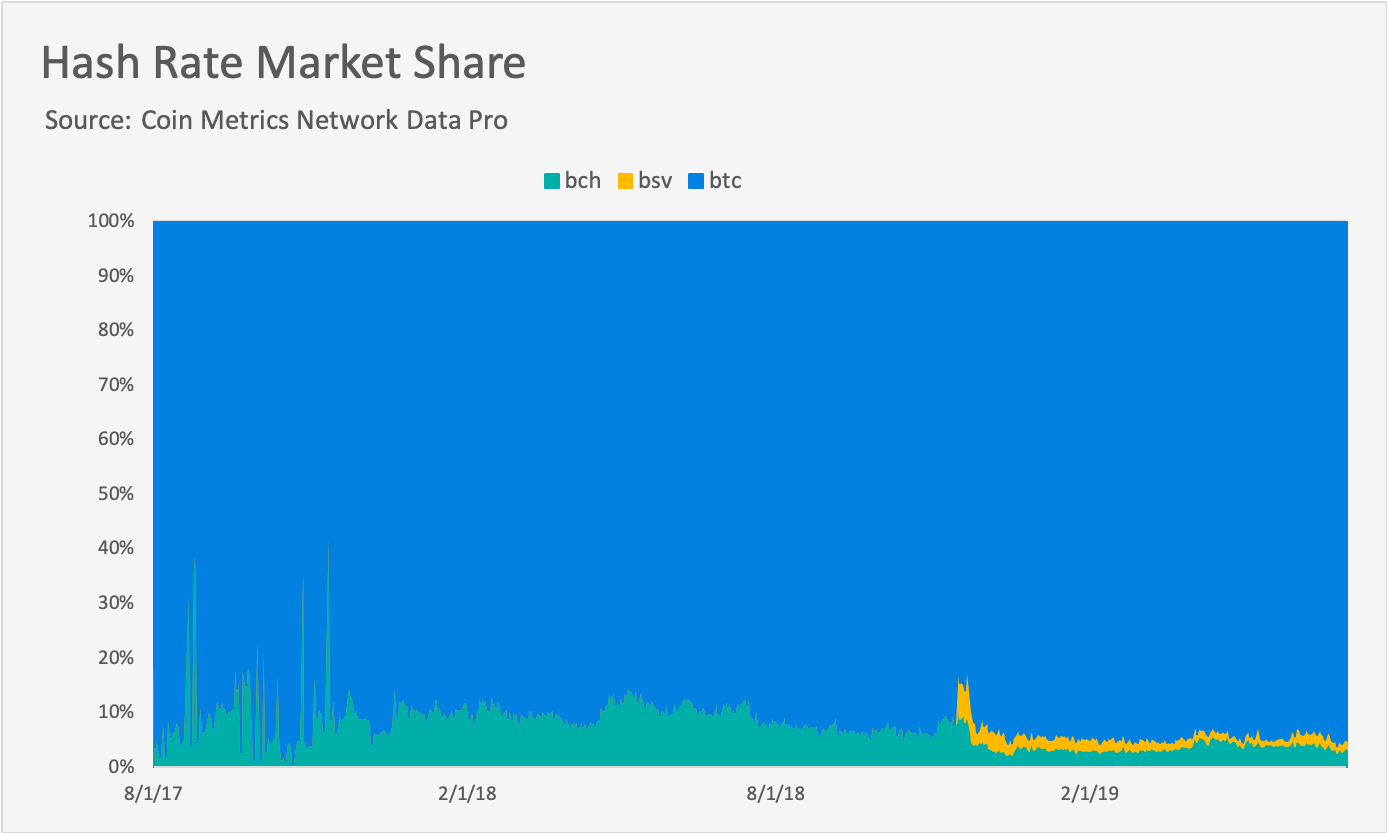

BTC has a huge hash rate lead over both BCH and BSV. Although BCH temporarily rivaled BTC’s hash rate in late 2017 (due to miners gaming the BCH difficult adjustment algorithm), BTC has since decisively pulled away. Furthermore, BCH’s hash rate decreased significantly when BSV forked in November 2018.

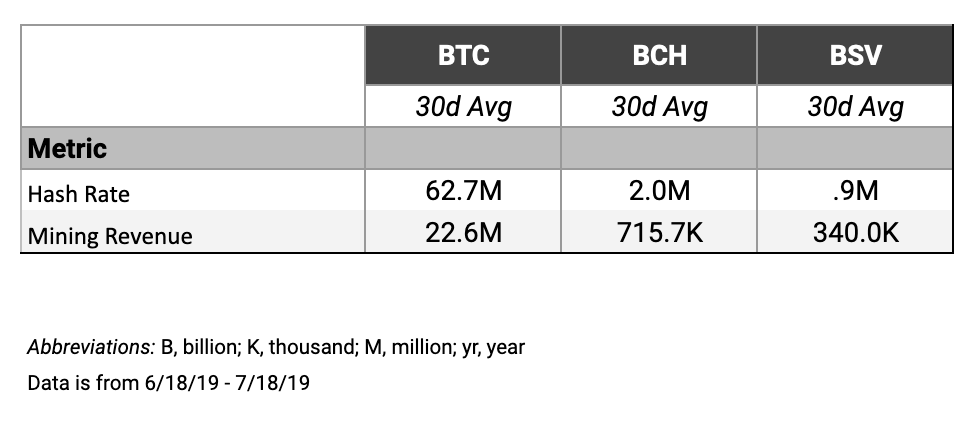

The below chart shows the daily mean daily hash rate for BTC, BCH, and BSV on a log scale. BTC’s hash rate recently peaked at 74.55M TH/s on July 5th, while BCH and BSV’s peak daily hash rate of the year (2019) so far have been 2.7M and 1.49M, respectively:

Overall, BTC still has a huge majority of hash rate compared to both BSV and BCH. As seen below, BTC has over 95% of the hash rate market share (amongst BTC, BCH, and BSV) as of July, 2019:

Mining revenue

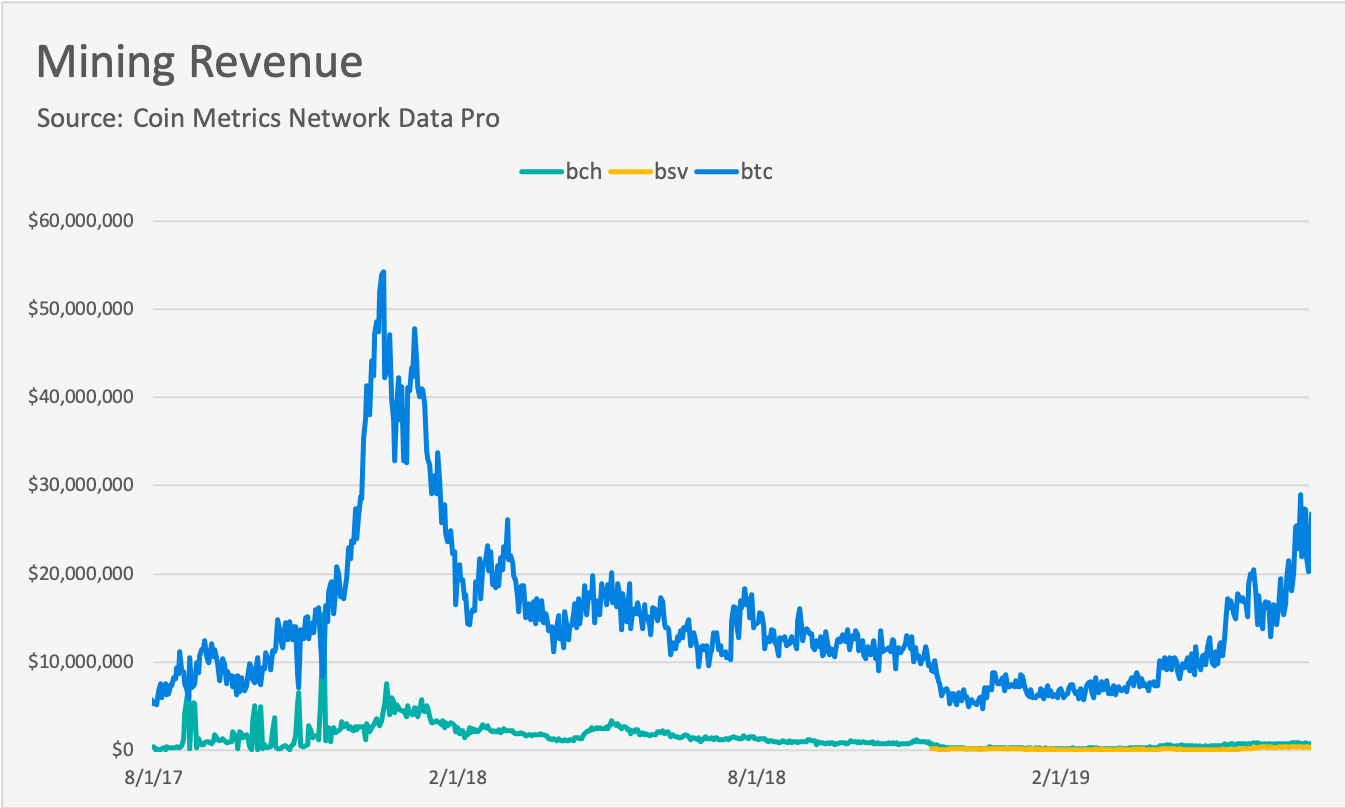

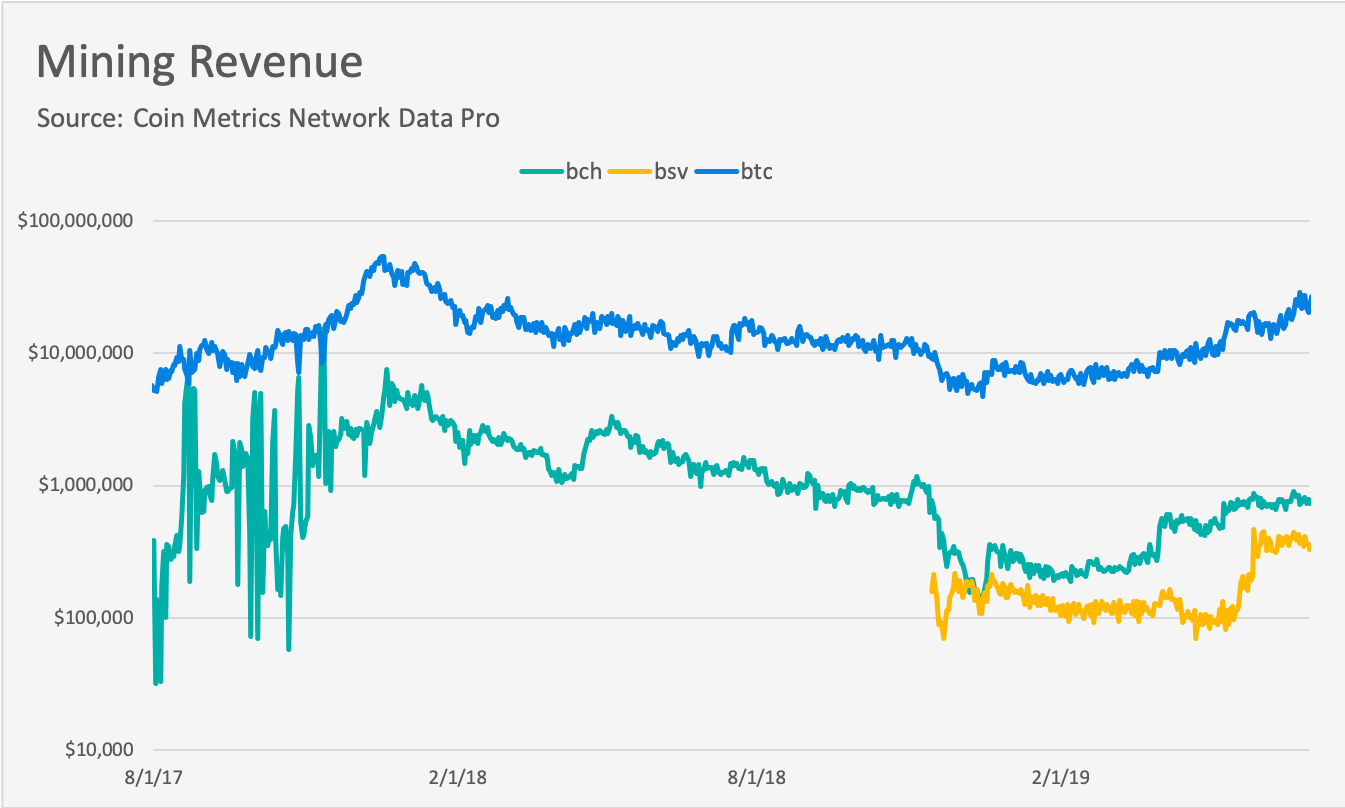

Mining revenue is another important security metric. We define mining revenue as “the sum USD value of all miner revenue (fees plus newly issued native units, i.e. block rewards) on a given day.” Mining revenue represents the incentive pool for miners; increase in mining revenue incentivizes more miners to join the market.

The below chart shows total mining revenue of the three blockchains. BTC has millions more dollars of daily mining revenue than both BCH and BSV combined:

Transaction fees are an increasingly important part of total mining revenue. The BTC (and by extension, BCH and BSV) block reward halves every 210,000 blocks, with the next halving expected to occur in May 2020. As block rewards move towards zero, transaction fees become a larger proportion of mining revenue. This will be an especially important consideration for BCH and BSV, both of which currently have less than $500 of daily total fees.

The below chart shows daily mining revenue, on a log scale:

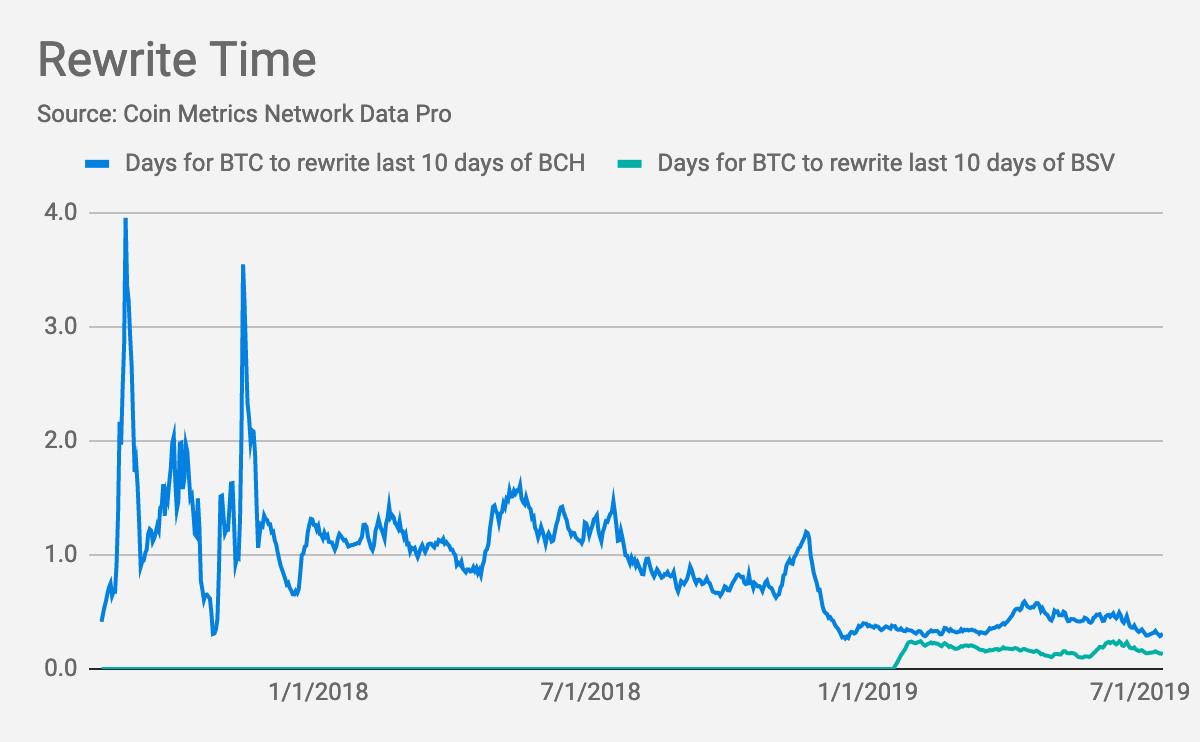

Rewrite Time

We also looked at the amount of time it would take BTC miners to rewrite ten days of the BCH and BSV blockchains. In this theoretical attack, all BTC miners stop mining the BTC blockchain, and instead collectively work to rewrite one of the other two chains. It would take BTC miners three hours to rewrite ten days of the BSV blockchain, and seven hours to rewrite ten days of the BCH blockchain (if BTC miners performed the same attack on BTC, it would take them approximately ten days to rewrite ten days worth of history):

On BCH, this attack is only theoretical as the developers introduced a deep reorg protection. Any fork starting deeper than 10 blocks ago has to accumulate much more work than the main chain to be accepted.

Security Summary

BTC currently has a big lead over BCH and BSV in the four metrics we used to measure security. Although BCH briefly threatened BTC’s hash rate, it has since declined, and was further hurt by a hash rate split at the time of the BSV fork. BTC has over 95% of the hash rate market share (amongst BTC, BCH, and BSV) as of July, 2019.

BTC also dominates in terms of daily mining revenue. BTC has over 30 and 60 times more daily mining revenue than BCH and BSV, respectively. This will become even more of an issue as block rewards continue to halve, as BCH and BSV’s total transaction fees are negligible compared to BTC’s.

We also found that if BTC miners were to theoretically attack BCH they could rewrite ten days of the blockchain in 7 hours. If they were instead to attack BSV, they could rewrite it in 3 hours.

Ultimately, BTC remains a much more secure blockchain than both BCH and BSV. Both are currently losing ground on BTC, and have a long way to go to catch up.

Summary

Although BSV and BCH have some of the desirable features of a medium of exchange asset, like low transaction fees, this has not yet led to a large increase in activity as compared to BTC. Both BCH and BSV still only have a small fraction of the usage of BTC when measured by metrics like adjusted transfer value and active addresses.

Furthermore, BSV and BCH are increasingly being used as ways to store data on chain (often without an associated economic transaction), and not as a medium of exchange. BSV, in particular, is predominantly being used as a way to record data on-chain, with over 94% of transactions containing OP_RETURN, a majority of which come from a single weather application. BSV may ultimately be used as a data storage blockchain, likely due to their removal of the size restriction on OP_RETURN transactions.

Additionally, although both BCH and BSV have larger maximum block sizes than BTC, they have not yet utilized that extra space. For the most part, BCH and BSV’s daily average block size has remained well below BTC’s 1MB average.

Both BSV and BCH have had blocks that have exceeded BTC’s maximum blocks. BSV blocks, in particular, are increasingly being filled by OP_RETURN transactions. BSV and BCH’s increased block size may become a factor if either gain adoption as a data storage blockchain. But it does not appear to currently be a factor in terms of being used as a medium of exchange.

Additionally, BTC currently has a big lead over BCH and BSV in the four metrics we used to measure security. BTC has over 95% of the hash rate market share (amongst BTC, BCH, and BSV) as of July, 2019.

BTC also dominates in terms of daily mining revenue. BTC has over 30 and 60 times more daily mining revenue than BCH and BSV, respectively. This will become even more of an issue as block rewards continue to halve, as BCH and BSV’s total transaction fees are negligible compared to BTC’s.

We also found that if BTC miners were to theoretically attack BCH they could rewrite ten days of the blockchain in 7 hours. If they were instead to attack BSV, they could rewrite it in 3 hours.

As of now, BCH and BSV are not gaining real usage over BTC as a medium of exchange, and are not utilizing their larger block sizes. BTC also remains a much more secure blockchain than both BCH and BSV. It remains to be seen whether BCH and BSV can take more of BTC’s market share moving forward.