Chapter II

How Are Indexes Calculated?

To ensure an unbiased and comprehensive representation of a select market, indexes rely on a predetermined methodology.

The methodology determines the weighting, constituents, and rebalancing schedule. This set of index rules ensures that subjectivity does not influence index construction and that index users receive only objective information.

The first step in any index is selecting its constituents.

The key determinant is what the index provider is trying to represent – based on the index’s intended use case. In traditional finance, market capitalization, geography, investment theme, and currency denomination are some of the common parameters used to determine an index’s portfolio or constituents. Indexes can also apply investment screens or filters to narrow the constituent parameters based on fundamentals like price-to-earning ratios or other criteria such as meeting sustainability standards.

Many of these same parameters are useful for constructing cryptocurrency indexes. For example, the CMBI 10 is an indicator of the ten largest cryptoassets by free float market capitalization; CMBI Bitcoin monitors the price of Bitcoin denominated in US dollar; and the CMBI 10 Momentum is a thematic index that applies a short term momentum factor to the weighting of index constituents. As the institutionalization of crypto grows, more and more crypto indexes will be created to capture a wider range of market segments.

Another factor in index construction, which is more unique to crypto, is market eligibility criteria.

Due to the decentralized nature of crypto, prices are quoted on a variety of centralized and decentralized exchanges. This creates conditions where assets are priced differently across exchanges. For example, during much of Bitcoin’s trading history, prices have been markedly higher in Korea than elsewhere in the world, creating a condition more commonly called the “Kimchi Premium.”

Exchanges solely in the US have also faced issues of major price dislocations due to supply/demand dynamics. Furthermore, many exchanges offer limited market data and history. Thus, to ensure data integrity, Coin Metrics only includes data from the highest quality exchanges for each asset when constructing its single asset indexes.

Often in market capitalization weightings, index providers will take the free float adjusted market capitalization instead of the total market capitalization.

A free float methodology will calculate market capitalization by removing assets that are untradable thereby showing a better reflection of public supply. In traditional equity markets, this means that assets that are held privately or by insiders or are restricted from trading are not counted in the market capitalization calculation.

This type of calculation is especially useful in crypto markets, where the total market capitalization often consists of lost or locked-up tokens. By removing these untradable tokens from the market capitalization, a free float methodology better captures the supply/demand dynamics of a token or market.

Once an index’s constituents are chosen, an index provider must determine the constituent weighting within the index.

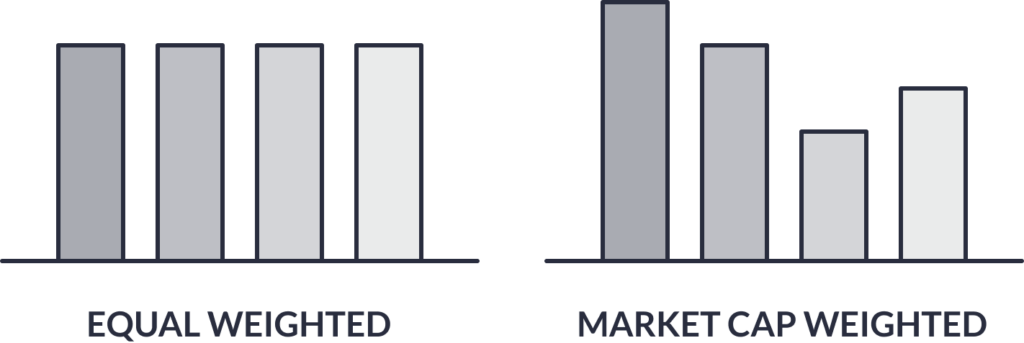

The simplest form of weighting is price weighting, where the provider sums all constituent prices and determines weighting based on percent of overall sum. For example, if a token was valued at $100 and was part of an index with a total value of $2000, it would comprise 5% of the total index. However, for multi-asset class indexes, the most commonly used methodologies for calculation are equal weighting and market capitalization weighting.

Equal weightings are the most basic weighting scheme as each asset in an index is weighted the same. This prevents any asset from having an outsized effect on the performance and increases the impact of smaller assets. Market capitalization weighting is determined by the size of an asset’s price multiplied by the number of outstanding shares (also known as market capitalization). Market capitalization is a better representation of an asset’s true value than price as it takes the total supply of an asset into account. In this weighting scheme, assets with the highest market capitalization have the largest weight and impact on the index.

There are a handful of other weighting methodologies that are also used across financial markets.

Some of these weighting methodologies include:

- Fundamental-weighting: a methodology where weighting is based on a asset statistic (such as price-to-earnings ratio) that is not market capitalization

- Capped Weighting: a methodology where an asset’s weight can not be above a certain percent

- Risk Control: a methodology that dynamically adjusts the weights of an asset based on its volatility to target a specific risk level

- Leveraged: a methodology that is based on financial derivatives and debt to amplify the returns of a specific basket of assets

- Inverse: A methodology designed to perform the opposite direction of an underlying basket of assets

- Smart Beta: a methodology that uses alternative weighting to capturing investment factors or market efficiencies obtain alpha or lower risk or diversification compared to another index

Once the constituents and weighting are determined, the index can be calculated.

The index value is determined by taking the price of the asset and multiplying it by the weighting and then summing each asset’s weighted value. The below example shows a basic market capitalization calculation.

| Asset | Price | Supply | Market Capitalization | Weight |

| Asset 1 | $5.00 | 10,000,000 | $50,000,000 | 27% |

| Asset 2 | $7.50 | 8,000,000 | $60,000,000 | 32% |

| Asset 3 | $3.00 | 25,000,000 | $75,000,000 | 41% |

| Total | $185,000,000 | 100% |

After the index is launched, the index provider is responsible for monitoring and maintaining the index.

As prices move, constituents and weightings can change, and thus, the index will need to be updated, or rebalanced. The methodology of an index will determine how frequently a rebalancing will occur (often monthly, quarterly, or annually). When a rebalancing occurs, the index provider will reselect constituents and reweight them. Sometimes, a constituent will be replaced during this time.

For more information on the methodologies behind Coin Metrics Bletchley Indexes, please refer to coinmetrics.io/cmbi-governance.

Chapter III

What Value Do Indexes Provide?

Indexes are an important part of the financial universe as they provide valuable insight to investors across many use cases.